Whole-Farm Revenue Protection provides a risk management safety net for all commodities on the farm under one crop insurance policy.

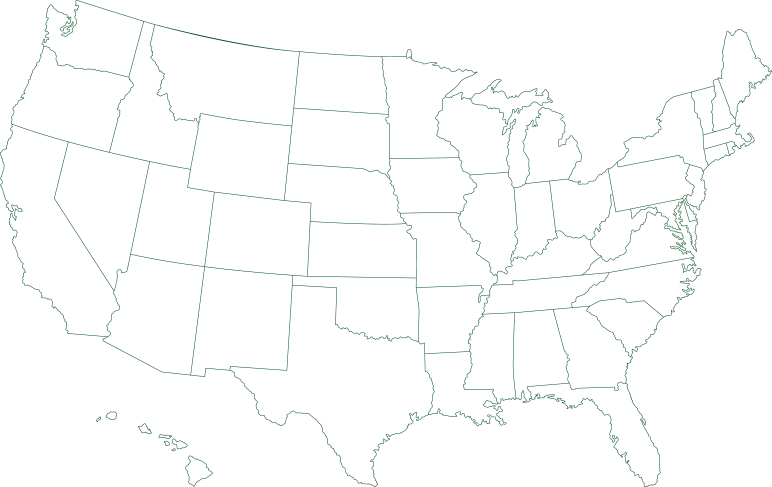

Whole-Farm Revenue Protection (WFRP) provides a risk management safety net for all commodities on the farm under one insurance policy and is available in all counties nationwide. This crop insurance plan is tailored for any farm with up to $17 million in insured revenue, including farms with specialty or organic commodities (both crops and livestock), or those marketing to local, regional, farm-identity preserved, specialty, or direct markets.

Safety net for all commodities on the farm under one insurance policy.

Tailored for small farms up to $17 million in insured revenue

Can have specialty or organic commodities, includes both crops and livestock (*this can either be on own or with specialty/organic)

Available to those who market to local, regional, farm-identity preserved or direct markets

How WFRP Works

WFRP provides protection against the loss of insured revenue due to an unavoidable natural cause of loss which occurs during the insurance period and will also provide carryover loss coverage if you are insured the following year. See the policy for a list of covered causes of loss.

2023 WFRP Program Improvements

The following changes to the WFRP plan of insurance and the Micro Farm (en español) program are applicable for the 2023 crop year and succeeding policy years:

- Increase to the maximum insurable revenue for WFRP from $8.5 million to $17 million, allowing more producers to participate in the program;

- Replace the existing expense reporting procedures with a 40% reduction in expected revenue for commodities which cannot be planted due to insurable causes. This reduction results in a similar value to prevented planting payments for other FCIC reinsured programs while reducing the total amount of paperwork required for the policy;

- Adjust the yield reporting requirements at the sales closing date to streamline record keeping and reduce overall paperwork; and

- Increases the maximum approved revenue for the Micro Farm program from $100,000 to $350,000, addressing stakeholder concerns that the low maximum approved revenue was limiting access to Micro Farm for local foods producers.

WFRP is available in all counties in all 50 states.

WFRP provides protection against the loss of insured revenue due to an unavoidable natural cause of loss which occurs during the insurance period and will also provide carryover loss coverage if you are insured the following year. See the policy for a list of covered causes of loss.

Sales Closing, Cancellation and Termination Dates

- Calendar year and early fiscal year filers | January 31, February 28, or March 15 (by county)

- Late fiscal year filers | November 20

- Revised Farm Operation Reporting Date (All filers) | July 15

- Contract Change Date | August 31

Coverage is provided for the duration of the producer’s tax year (the insurance period). The insurance period is a calendar year if taxes are filed by calendar year, or a fiscal year if taxes are filed by fiscal year.

Whole-Farm Revenue Protection protects your farm against the loss of farm revenue that you earn or expect to earn from:

- Commodities you produce for sale during the insurance period

- Commodities you buy for resale during the insurance period (limits apply)

- Animals and animal products (limits apply)

- All commodities on the farm except timber, forest and forest products; and animals raised for sport, show or pets

You can buy WFRP alone or with other “buy-up” level (additional coverage) Federal crop insurance policies. When you buy WFRP with another Federal crop insurance policy, the WFRP premium is reduced due to the coverage provided by the other policy. If you have other Federal crop insurance policies at catastrophic coverage levels you do not qualify for WFRP.

Operations that have been expanding over time may be allowed to increase their approved revenue amount based on an indexing procedure. If you can show that your operation has physically expanded (land, facilities or production capacity) so it has the potential to produce revenue greater than the historic average, your Approved Insurance Provider (AIP) may approve your operation as an expanding operation up to 35% over average revenue to reflect that growth in the insurance guarantee. If you can show your operation has physically expanded based solely on certified organic production, your AIP may approve your operation as an expanding operation up to the higher of 35% or $500,000 more than the historic average.

Claims are settled after taxes are filed for the policy year. A loss under the WFRP policy occurs when the WFRP revenue-to-count for the insured tax year falls below the WFRP insured revenue.

How is a WFRP indemnity calculated?

Claims are settled after taxes are filed for the policy year. A loss under the WFRP policy occurs when the WFRP revenue-to-count for the insured tax year falls below the WFRP insured revenue. Revenue-to-count for the insured tax year is: (list) – Revenue from the tax form that is ‘approved revenue’ according to the policy – Adjusted by excluding inventory from commodities sold that were produced in previous years – Adjusted by including the value of commodities produced during the tax year that have not yet been harvested or sold – Any other adjustments required by the policy such as those from uninsured causes of loss.

WFRP Crop Insurance Policy Information:

- WFRP Pilot Policy (23-0076) (Aug 2022) PDF

- Micro Farm Pilot Policy (23-MF-WFRP) (Nov 2022) PDF

- Combo Form – 2025 Whole-Farm Revenue Protection (WFRP) – New Policy

- Combo Form – 2025 Whole-Farm Revenue Protection (WFRP) – Renewal Policy

- Combo Form – 2025 Whole-Farm Revenue Protection (WFRP) – New Policy with PAW

- Combo Form – 2023\5 Whole-Farm Revenue Protection (WFRP) – Renewal Policy with PAW

- Substitute Schedule F for WFRP Purposes

Other Helpful Information:

- Acceptable Records for Whole-Farm Revenue Protection (WFRP) Policies (2024)

- Frequently Asked Questions for Whole-Farm Revenue Protection Plan 2023

- USDA Announces Whole-Farm Revenue Protection Program Improvements for 2021 Crop Year

Recordkeeping Aids for Direct Market Producers:

"*" indicates required fields