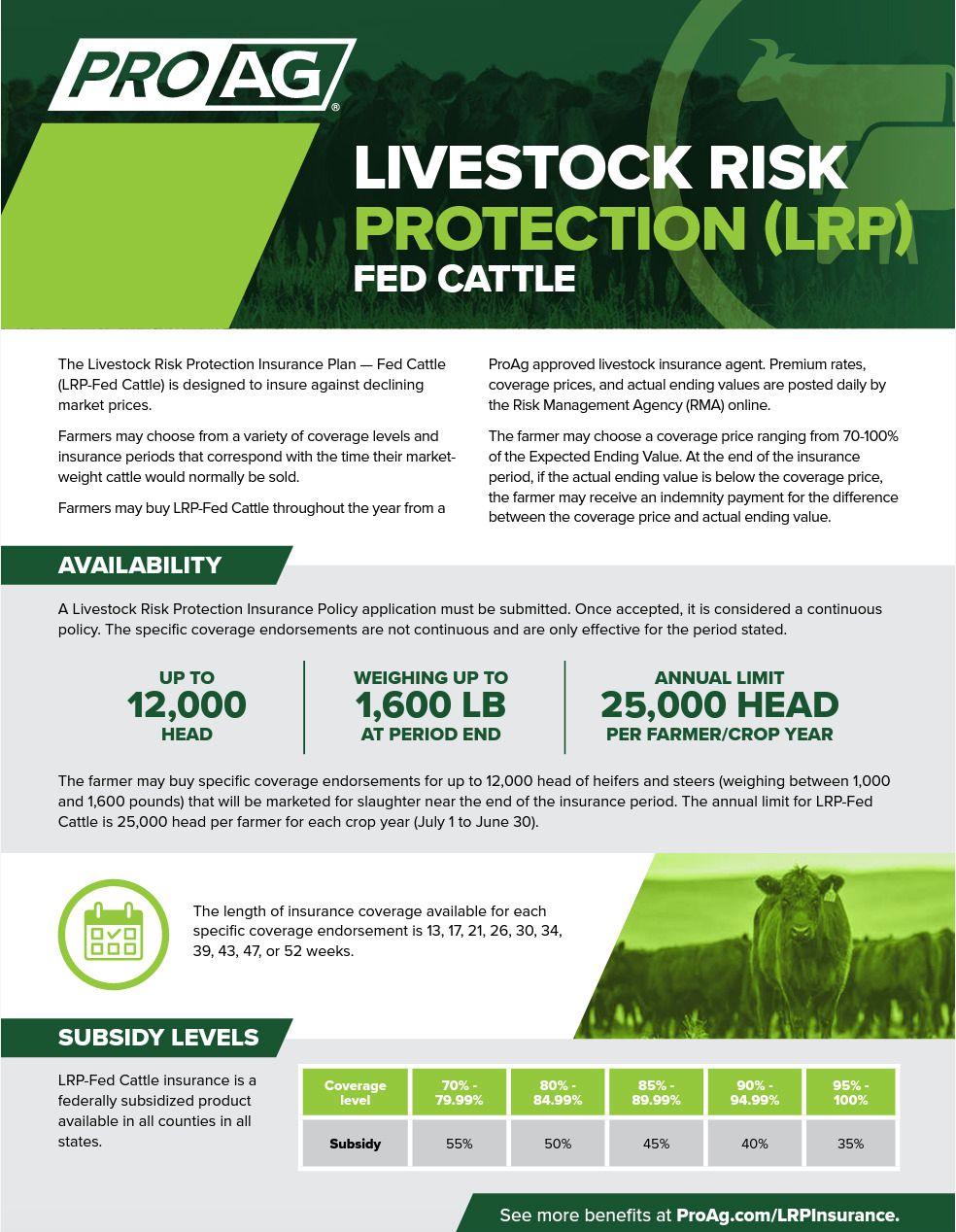

Livestock Risk Protection (LRP) insurance protects against declining market prices (based on the USDA Agricultural Market Service).

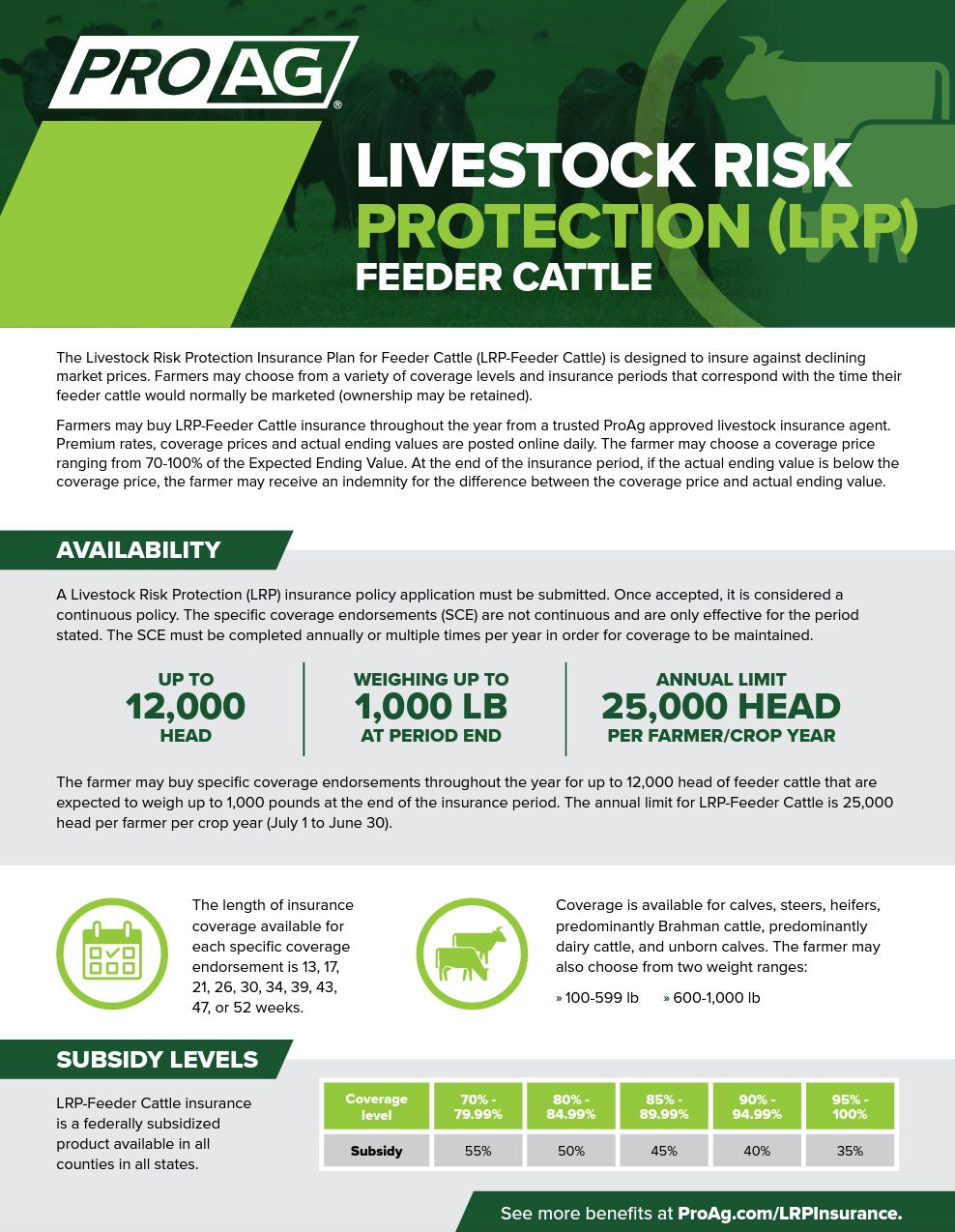

Producers and ranchers may choose from a variety of coverage levels and insurance periods that correspond with their operations. The producer may choose a coverage price ranging from 70-100% of the Expected Ending Value. At the end of the insurance period, if the actual ending value is below the coverage price, the farmer may receive an indemnity payment for the difference between the coverage price and actual ending value. This federally subsidized crop insurance program typically costs less than other marketing options, is often perceived more favorably by lenders and may provide additional benefits in terms of lending rates or loan availability.

Secures a minimum price look for your marketable animals while leaving the upside price potential open.

Insures your animals with no minimum head limits and large maximum head limits.

Includes flexible coverage levels from 70% to 100% and premiums paid at the end of the endorsement period.

Has year-round availability with numerous coverage periods.

Offers federal subsidies up to 55%, with no brokerage fees or margin calls required.

LRP insurance protects your investment should prices drop before your livestock gets to market while preserving your upside potential.

- Available for swine, fed cattle and feeder cattle

- Coverage level options ranging from 70-100% of the expected ending market value of animals

- Flexibility of number of head you can insure

- Feeder Cattle – 12,000 head per endorsement/25,000 head annually

- Fed Cattle – 12,000 head per endorsement/25,000 head annually

- Swine – 70,000 head per endorsement/750,000 head annually

- Coverage can be extended to unborn calves, including those operations with multiple entity structures

- Coverage can be based upon forward contract or purchase agreement with additional documentation.

Recent LRP Insurance Policy Changes

USDA announced improvements to the Livestock Risk Protection (LRP) insurance program to make these policies more usable and affordable for livestock producers. Specifically, the changes made were to:

- Modified the termination date to September 30th and the premium billing date to the first day of the second month after the end date.

- Added two new types:

- For Feeder Cattle, Unborn Calves provided coverage for beef or beef/dairy cross calves sold within two weeks after birth; and

- For Fed Cattle, Cull Cows provided coverage for dairy cull cows with a coverage limitation of 13 weeks.

- Allowed coverage based on a forward contract or purchase agreement.

- Additional record requirement includes a copy of the purchase agreement and proof of delivery.

- Added a drought exemption for Feeder Cattle that will be based on the Drought Monitor’s Drought Severity and Coverage Index.

- Updated the correction of errors language in the handbook and added similar language to the policy.

- Added additional record requirements for Feeder Cattle:

- When livestock are purchased and not marketed within 60 days of the end date; and

- The sex of the feeder cattle must be verified in the marketing or purchase records.

- Added language that outlines what is considered subsidy capture and specifies subsidy capture is not allowable.

- Updated the termination/ineligibility language.

- Added single payee changes.

Dive deeper into LRP insurance

Buying a Policy

The LRP insurance program’s coverage prices, rates, actual ending values and per hundredweight cost of insurance may be viewed on the RMA website here. The actual ending values are based on price series data from the USDA Agricultural Marketing Service (swine), weighted prices from the Chicago Mercantile Exchange Group Feeder Cattle Index (feeder cattle) or weighted prices from USDA Agricultural Marketing Service (fed cattle). Actual ending values are posted on the RMA’s website at the end of the insurance period.

LRP insurance sales are typically offered every market trading day. These begin in the afternoon, shortly after the market closes, and run until exactly 8:25 a.m. CST the following morning.

LRP insurance can be purchased through a ProAg-certified livestock insurance agent. An application can be filled out at any time. However, insurance does not attach until the farmer buys a specific coverage endorsement. The farmer may buy multiple specific coverage endorsements with one application. Insurance coverage starts the day the farmer buys a specific coverage endorsement and RMA approves the purchase.

The premium is billed by the premium billing date; the first day of the second month following the end date for the specific coverage endorsement and is listed in the Actuarial Documents.

Find a ProAg Agent

Pro Ag Management, Inc.* (collectively with its corporate affiliates, “ProAg®”) is a managing general agency representing several risk bearing insurance companies, including Producers Agriculture Insurance Company and U.S. Specialty Insurance Company and doing business as Pro Ag Insurance Services, Inc. in California, CA Entity License #0F34212. The insurance products described on this website may not be a complete list of all products offered and may not be offered in all states. The provided information does not amend, or otherwise affect, the terms and conditions of any insurance policy issued by ProAg or any of its subsidiaries; always refer to the policy provisions. Actual coverages will vary based on the terms and conditions of the policy issued.