USDA-FAS Reports Provide Updates on Ag Trade and Production

On Thursday, the USDA’s Foreign Agricultural Service (FAS) released three reports that provided updated information on agricultural trade, production and recent impacts of the COVID-19 outbreak. A focus on wheat and rice, protein markets, and soybeans are included in today’s update.

Wheat and Rice

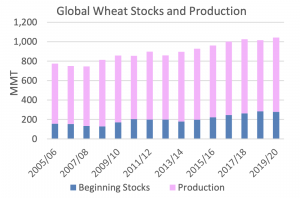

In its Grain: World Markets and Trade report, FAS stated that, “In the wake of COVID-19, concerns have emerged over food security. Some countries have placed trade-restrictive measures, while others have issued tenders for more purchases. Consequently, prices have rallied for both wheat and rice, even though global supplies are at record levels and the share of stocks to consumption is historically high.”

The report explained that, “Global wheat production is estimated at a record high in 2019/20. Major producers such as China, the European Union, India, Russia, and the United States have produced at levels that are more than sufficient to meet rising global demand. Furthermore, wheat harvests in major producing countries in the Northern Hemisphere are only a few months away.

“Wheat ending stocks are also projected at a record with China holding about half of global stocks. Furthermore, India, the world’s third-largest producer, has ending stocks projected at a 7-year high on several consecutive years of bumper crops.”

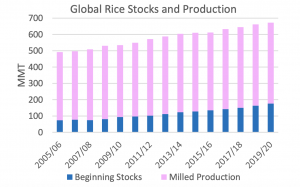

With respect to rice, FAS pointed out that, “Although several regions’ production levels are down year-over year, a bumper 2019/20 global rice harvest is still expected, with production just around half a percent lower from the prior year record.”

“Even with lower production, overall supplies are up from the prior year because of record carryin stocks. Stocks are particularly high in China and India, both major exporters,” the report said.

FAS stated that,

Although some trade-restrictive measures have been put in place, global wheat and rice supplies are at record levels and are large enough to meet global demand.

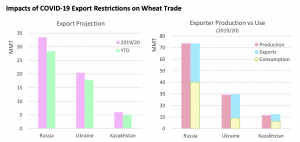

Thursday’s report also noted that, “Despite sufficient global supplies and the upcoming harvest season, several key exporters have put in place various forms of trade restrictions in order to increase domestic food security. In particular, Russia, Ukraine, and Kazakhstan have each imposed export restrictions for wheat (among other commodities) for the months of April to June 2020, creating near-term regional and global supply concerns.”

Protein Markets

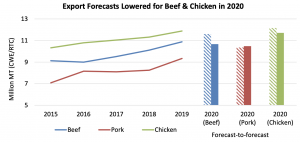

Also on Thursday, FAS released its Livestock and Poultry: World Markets and Trade report, which stated that, “Global export forecasts for beef and chicken meat trade have been trimmed due to emerging threats from the spread of the COVID-19 virus. Economic growth forecasts have been cut for 2020 and the impact on consumers will dampen demand for animal protein. Widespread closures of restaurants and food service outlets as well as a reduction in tourism and travel will shift demand for protein among both types of meat as well as cuts. Furthermore, shipping disruptions have already impacted global trade by clogging ports and reducing container availability, at least in short run.”

However, with respect to pork, the report noted that, “Contrasting extensive economic headwinds, impacts from African swine fever in China and other countries remain a dominant factor in the market for pork. Exports are raised for pork as sharply lower pork production in China is still expected to drive record trade. However, COVID-19 has added significant uncertainty to the forecasts and is expected to disrupt trade in 2020.”

Soybeans

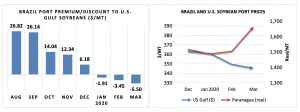

And in its Oilseeds: World Markets and Trade report on Thursday, FAS stated that, “Brazil’s soybean exports in March approached a record 12 million tons, eclipsed only by port loadings that came in at 13.4 million tons. Roughly three-quarters of March exports were destined for China. Discounting in Paranagua relative to the U.S. gulf along with flush supplies from the recent harvest are helping to drive sales.”

FAS pointed out that, “Sales and exports are also being driven by record Brazilian prices in reals as producers hope to take advantage of the near free-fall in the Brazilian real relative to the dollar. Since January 1, the real has depreciated by one-third with more than half of the fall occurring in March.”

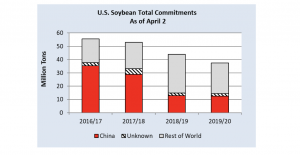

More broadly, the report indicated that, “With Brazil’s sales to China surging, U.S. sales to China remain sparse. Private buyers in China have only been able to access U.S. soybeans and avoid the tariffs since early March. While Brazilian sellers continue to price agressively given the record local prices, few purchases of U.S. soybeans by China are anticipated in the coming weeks. With the global COVID-19 pandemic expected to continue for some time, the factors driving the U.S. dollar higher are unlikely to abate in the near term. Only when supplies in Brazil dwindle later in 2020 will there be opportunity of increased U.S. sales to China.”

“U.S. soybean export commitments (outstanding sales plus accumulated exports) to China have fallen slightly behind last year’s levels on weak sales, totaling 12.6 million tons compared to 12.9 million a year ago. A weakened real has allowed Brazilian soybeans to be more price-competitive. Total commitments to the world were also lower than last year, totaling 37.4 million tons compared to 43.8 million tons the year before,” the FAS report said.

Source: Keith Good, Farm Policy News