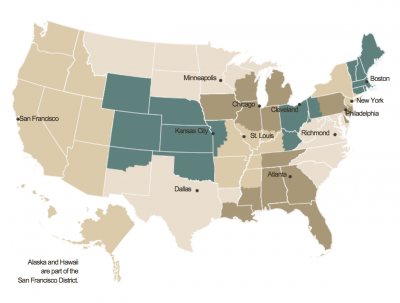

Federal Reserve: Observations on the Ag Economy- February 2019

On Wednesday, the Federal Reserve Board released its February 2019 Beige Book update, a summary of commentary on current economic conditions by Federal Reserve District. The report included several observations pertaining to the U.S. agricultural economy.

* Sixth District- Atlanta– “Agricultural conditions across the District were mixed. Recent reports showed that most of the District was drought-free, with the exception of small areas in south Florida and coastal Louisiana where conditions were abnormally dry. The February forecast for Florida’s orange crops was unchanged from the previous month but remained significantly ahead of last year’s production. Since November, weekly cash prices were up for corn, soybeans, beef and broilers, while cotton and rice prices were down.”

* Seventh District- Chicago– “Prices for corn were up a bit over the reporting period, while soybean and wheat prices moved lower.

“Iowa Ag News – Monthly Prices,” Upper Midwest Regional Field Office. USDA- National Agricultural Statistics Service (February 28, 2019).

Contacts expected crop incomes to be lower in 2019 compared with 2018, anticipating that prices will stay low and the harvest will be smaller than 2018’s bumper crop.

“They also thought low soybean prices would lead farmers to switch some fields from soybeans to corn. Contacts noted positive reports on trade talks between the U.S. and China—including news that China bought some U.S. soybeans. Livestock prices increased overall, and harsh winter weather required extra feeding expenditures for animals.”

* Eighth District- St. Louis– “District agriculture conditions declined slightly from the previous reporting period. The number of acres of winter wheat planted this season decreased slightly from last year’s total.

Local agriculture contacts continued to express pessimism about the industry in the near term as low commodity prices and rising input costs strain farm incomes.

* Ninth District- Minneapolis– “District agricultural conditions were stable at low levels. Crop production estimates indicated that 2018 was a strong year throughout the District, with new records in some states.

However, producers continued to struggle with low commodity prices and expressed concerns about the effects of trade tensions.

“Respondents to the Minneapolis Fed’s fourth-quarter (January) survey of agricultural credit conditions indicated that farm income and capital spending decreased relative to a year earlier, with further declines expected for the coming three months.”

* Tenth District- Kansas City– “Farm income continued to decline slightly, but farmland values remained relatively stable in the Tenth District.

“Farm income decreased throughout the region in the last survey period according to District representatives, but modest increases in both crop and livestock prices could improve revenues for some farm operations moving forward. Demand for agricultural loans remained strong, and contacts reported a slight reduction in funding availability. Additionally, repayment rates on agricultural loans slowed modestly, and interest rates on farm loans increased slightly.

“Despite persistent weaknesses in farm finances and higher interest rates, farmland values remained relatively stable. However, a majority of contacts expected farmland values to decline moderately in 2019. However, District contacts indicated that demand for farmland remained high, and the volume of farmland sales compared to last year increased modestly in Nebraska and Kansas.”

* Eleventh District- Dallas– “Prospects for 2019 crops heading into the spring planting season were strong thanks to favorable soil moisture conditions. Producers were behind in field preparation work because of soil saturation, with planting expected to be delayed in some regions. Overall, contacts expect average to above-average crop yields this year but noted the financial situation of many producers continued to be a concern due to generally low crop prices. On the livestock side, grazing conditions were looking better this year than last and beef demand remained strong.”

* Twelfth District- San Francisco– “Conditions in the agriculture sector deteriorated modestly. Many contacts continued to cite trade policy changes as a source of weaker sales abroad and general uncertainty, though factors such as a stronger dollar and the moderation in the housing market also played a role. A contact in Eastern Washington observed that demand from China for fruit crops declined, and a contact in California noted that walnut exports declined.

Oversupply in dairy markets persisted, hurting profitability and forcing some producers in the Mountain West to exit the market.

“In Idaho, profitability at beef producers picked up, though it was still below levels seen a year ago. A California contact noted that the outlooks for crop yields and inventories improved further after rainfall beat expectations over the reporting period.”

Source: Keith Good, Farm Policy News