ERS Report-“Interdependence of China, United States, and Brazil in Soybean Trade”

Late last week, the U.S. Department of Agriculture’s Economic Research Service (ERS) released a report (“Interdependence of China, United States, and Brazil in Soybean Trade,” by Fred Gale, Constanza Valdes, and Mark Ash) that discussed “factors driving China’s imports of soybeans and production in Brazil and the United States, price dynamics, and market adjustments to China’s retaliatory tariff on U.S. soybeans.” Today’s update includes highlights from the ERS report.

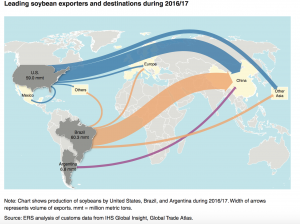

The report stated that, “Geographic concentration of soybean importers and exporters is a distinguishing feature of the global soybean market. During 2016/17, the United States and Brazil together accounted for 83 percent of world soybean exports. The United States exported 59 mmt of soybeans and Brazil exported 63 mmt, while Argentina was the third-leading exporter with 6.9 mmt. China was the destination for 61 percent of U.S. soybean exports and 77 percent of Brazil’sthat year.”

Interdependence of China, United States, and Brazil in Soybean Trade, OCS-19F-01. USDA, Economic Research Service (June 2019).

“Soybeans are the most prominent agricultural commodity exported to China by both the United States and Brazil. During 2017, soybean exports valued at $12.3 billion accounted for 63 percent of U.S. agricultural exports to China. Soybeans accounted for less than 20 percent of U.S. agricultural exports to other regions,” the report said.

Interdependence of China, United States, and Brazil in Soybean Trade, OCS-19F-01. USDA, Economic Research Service (June 2019).

“The share of soybeans in Brazil’s agricultural exports to China was even larger. During 2017, $20.3 billion of soybean exports accounted for nearly 88 percent of Brazil’s agricultural exports to China.”

Interdependence of China, United States, and Brazil in Soybean Trade, OCS-19F-01. USDA, Economic Research Service (June 2019).

Gale, Valdes, and Ash explained that, “The concentration of soybean trade meant that Brazil was the only exporter capable of supplying China with large volumes of soybeans to replace U.S. soybeans after China imposed its tariff in 2018.”

Interdependence of China, United States, and Brazil in Soybean Trade, OCS-19F-01. USDA, Economic Research Service (June 2019).

“In parallel, increases in U.S. soybean exports to the European Union, Egypt, Iran, Mexico, and other countries did not fully offset the decline in exports to China during 2018. During the first 6 months of the U.S. soybean marketing year 2018/19, exports to China were down 21.7 mmt from a year earlier…From September 2018 to February 2019, U.S. soybean exports were down 12.1 mmt from the same period a year earlier,” the ERS report said.

Interdependence of China, United States, and Brazil in Soybean Trade, OCS-19F-01. USDA, Economic Research Service (June 2019).

More narrowly with respect to China’s soybean imports, Gale, Valdes, and Ash pointed out that, “After rising nearly 65 mmt from 2006 to 2016, China’s soybean imports declined during 2018 for the first time in 15 years.”

Interdependence of China, United States, and Brazil in Soybean Trade, OCS-19F-01. USDA, Economic Research Service (June 2019).

And, “During 2018, soybeans comprised 30 percent of the value of China’s agricultural imports, the largest category.”

Interdependence of China, United States, and Brazil in Soybean Trade, OCS-19F-01. USDA, Economic Research Service (June 2019).

Last week’s report stated that, “China’s consumption of both soybean meal and oil has grown dramatically since the country began importing soybeans.

Estimates from USDA’s Production, Supply and Distribution database show that China used just 1 mmt each of soybean meal and oil in 1990. Estimated soybean meal use grew to 68.6 mmt, and soybean oil use grew to 16.4 mmt in 2016/17. From 2007 to 2017, USDA estimates indicate that China’s soybean meal use rose nearly 40 mmt, and soybean oil use grew 7.7 mmt.

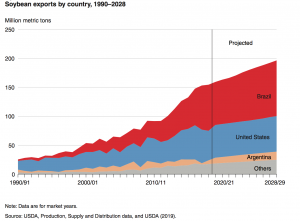

After additional analysis on the issue of China’s soybean imports, the authors turned to a closer look at the competition between the U.S. and Brazil to supply China with soybeans, and stated that, “With China’s tariffs assumed to remain in place, USDA (2019) projected that U.S. soybean exports would rise to 61.4 mmt and Brazil’s exports would rise to 96.1 mmt in 2028.”

Interdependence of China, United States, and Brazil in Soybean Trade, OCS-19F-01. USDA, Economic Research Service (June 2019).

Also with respect to the Chinese tariffs, ERS indicated that, “As the tariff took full effect during the first 5 months of China’s 2018/19 market year, Brazil’s share rose to 77 percent, while the U.S. share fell to 4 percent.”

Interdependence of China, United States, and Brazil in Soybean Trade, OCS-19F-01. USDA, Economic Research Service (June 2019).

After a more detailed examination of variables associated with soybean output growth in the U.S. and Brazil, which propelled exports from the two countries, Gale, Valdes, and Ash explained that, “Competition between U.S. and Brazilian soybean exporters for sales to Chinese buyers tends to equalize the two countries’ soybean export prices.”

Interdependence of China, United States, and Brazil in Soybean Trade, OCS-19F-01. USDA, Economic Research Service (June 2019).

“Brazilian and U.S. prices did diverge after China’s tariff was announced in 2018, but the divergence lasted only 6 months. Daily soybean prices for Paranaguá and U.S. Gulf ports from January 2018 to March 2019 show Brazilian and U.S. prices clearly diverged after China announced its tariff on U.S. soybeans in June 2018…The premium for Brazilian soybeans over U.S. Gulf soybeans peaked at 28 percent—slightly more than the tariff on U.S. soybeans—in October 2018.”

Interdependence of China, United States, and Brazil in Soybean Trade, OCS-19F-01. USDA, Economic Research Service (June 2019).

The ERS report pointed out that, “The geographic concentration of soybean trade is unlikely to change in the future, even if China’s tariff on U.S. soybeans were retained indefinitely. The high yields, cost advantage, and established marketing channels would make it dif cult for new countries to increase exports of soybeans that could effectively compete with Brazilian and U.S. producers.”

In parallel, China is likely to remain the dominant source of demand growth for soybeans, making it difficult for U.S. exporters to develop new soybean markets as alternatives to China.

Gale, Valdes, and Ash stated that, “USDA 10-year projections released in 2019 assumed the Chinese tariff on U.S. soybeans would be retained indefinitely since there was no way to predict when the policy would change. Comparing these projections with the previous year’s USDA projections, which were made before U.S.–China trade tensions began, provides an indication of how China’s tariff might affect soybean trade in the future.

“The USDA projections show that China’s soybean imports would resume growing, but the volume of future soybean trade would be less than previously projected. The projections assuming the tariff is kept in place show China would import 122.8 mmt of soybeans by 2027, about 20 mmt less than the previous year’s projected imports of 143 mmt for 2027 (without the tariff assumption).”

Interdependence of China, United States, and Brazil in Soybean Trade, OCS-19F-01. USDA, Economic Research Service (June 2019).

“Soybean imports by other countries are projected to reach 69 mmt in 2027, about 7.5 mmt more than was projected the previous year before the China tariff was imposed. Thus, the increase in imports by non-China countries would offset less than half of the 20-mmt reduction in China’s imports, reducing the overall volume of soybean trade.”

Interdependence of China, United States, and Brazil in Soybean Trade, OCS-19F-01. USDA, Economic Research Service (June 2019).

With respect to the future outlook, the ERS authors noted that, “The interdependence of China, Brazil, and the United States in soybean trade is likely to persist. China’s demand for soybeans is expected to continue growing, and there are no major alternative suppliers in the near term. In parallel, alternate markets for U.S. soybeans can only absorb a fraction of the soybeans exported to China before trade tensions began. Lower U.S. prices stimulated additional demand by a number of countries, but these markets are not likely to absorb the entire volume displaced from China.”

“The main short-term impacts of China’s retaliatory tariff on U.S. soybeans were to reduce soybean prices for U.S. farmers and to increase China’s reliance on Brazil as a soybean supplier,” the authors said.

Last week’s report added that, “If China eliminates the tariff on U.S. soybeans, the global market is likely to have a severe glut as U.S. soybeans are released from storage, Brazil produces another large harvest, and Argentina’s production rebounds from a 2018 drought. A drop in soybean prices could prompt China’s importers to resume rapid growth in purchases.”

Source: Keith Good, Farm Policy News