What Is Multi-Peril Crop Insurance? (And other FAQs)

Crop insurance helps protect your farm and your future — but we know there’s a lot to learn about the subject. Independent ProAg agents are ready to help you find the right policy for your operation and we’re not stopping there. We’re answering some frequently asked questions to make sure you feel prepared for the seasons ahead.

Crop insurance helps protect your farm and your future — but we know there’s a lot to learn about the subject. Independent ProAg agents are ready to help you find the right policy for your operation and we’re not stopping there. We’re answering some frequently asked questions to make sure you feel prepared for the seasons ahead.

What is Multi-Peril Crop Insurance? Is it the only type of crop insurance?

There are two main categories of insurance for agriculture producers: Multi-Peril Crop Insurance (MPCI) and private products.

MPCI policies are crop insurance plans managed by the Federal Crop Insurance Corporation (FCIC) and USDA Risk Management Agency (RMA). They are administered by Approved Insurance Providers (AIPs) — like ProAg — and have federally subsidized premiums for farmers and ranchers. Coverage options are the same across AIPs, including pricing.

These federal policies can be supplemented with endorsements, which help add coverage for additional protection. Two popular endorsements are the Enhanced Coverage Option (ECO) and the Supplemental Coverage Option (SCO). Both increase the insurable percentage of your expected crop value, and triggers are based on county-level loss. ECO and SCO can be elected separately or together. However, each must be purchased from the same company as your existing MPCI policy.

Private products are crop insurance options developed by and administered by AIPs to fill gaps in coverage and enhance existing federal options. ProAg offers a variety of innovative private products, ranging from crop hail to Supplemental Replant Coverage.

Your local independent ProAg agent can help determine which federal and private product options are a fit for your risk management goals.

What MPCI plans exist?

Now that you know what Multi-Peril Crop Insurance is, it’s time to break down some of the available plans with federally subsidized premiums.

A range of individual plans fall under MPCI, including:

- Actual Production History (APH): Protects against a loss of production by guaranteeing a yield based on the actual production history of a farmer’s crops.

- Yield Protection (YP): Like APH, YP protects against a loss of production. In this case, coverage is determined by actual production history and a projected price for the crop.

- Revenue Protection (RP): Protects against loss of revenue caused by price increase or decrease, loss of production, or a combination of the two.

- Dollar plans of insurance: Protects against naturally occurring perils, with guarantees determined on values published in actuarial documents.

Farmers and ranchers can also choose from three area plans (also referred to as county-based plans) that protect against losses that affect an entire area, usually a county.

- Area Yield Protection (AYP): Protects against loss of production, as determined by county-level production.

- Area Revenue Protection (ARP): Protects against loss of revenue, as determined by county-level production loss, price increase or decrease, or a combination of both.

- Area Revenue with Harvest Price Exclusion (ARP-HPE): Much like ARP, this policy protects against loss of revenue. However, it does not adjust the revenue guarantee to reflect harvest prices that are higher than the projected price.

MPCI also includes Livestock Risk Protection (LRP) and Dairy Revenue Protection (DRP) to protect farmers and ranchers against price declines.

What are the most common crop insurance plans?

It all depends on which commodities farmers and ranchers need to protect. When it comes to Rainfall Index plans, Pasture, Rangeland, Forage (PRF) policies are the most common. They protect against costs related to a loss of forage due to a lack of precipitation.

Revenue protection is another popular option, thanks to the combination of protection against loss of production and loss of revenue.

How do Revenue Protection (RP) plans work?

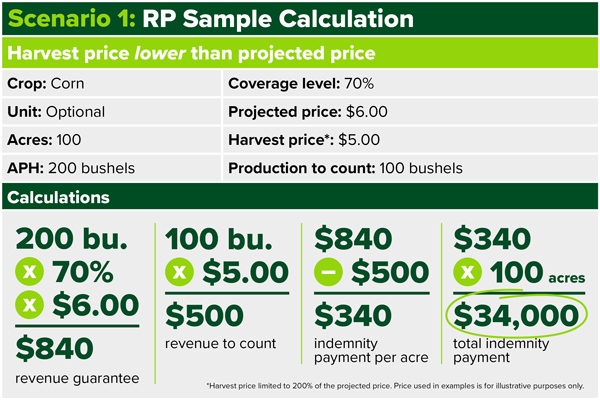

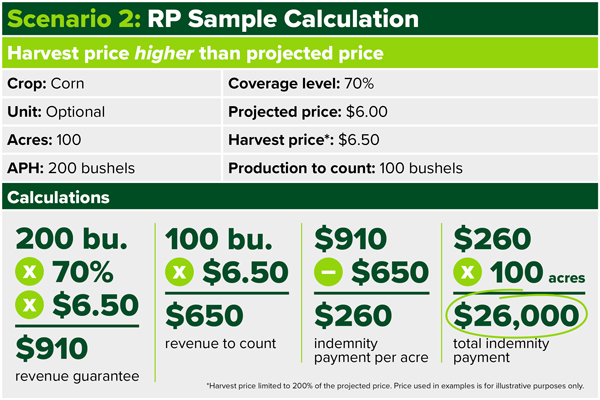

RP plans take your actual production history, the projected price for your insured commodity (as determined by the Commodity Exchange Price Provisions [CEPP]), and your chosen coverage level to create a revenue guarantee. An indemnity payment is triggered when your revenue-to-count is lower than your revenue guarantee. RP protects against both increases and decreases in price. The revenue guarantee is decided based on either the projected price or the harvest price — whichever is higher.

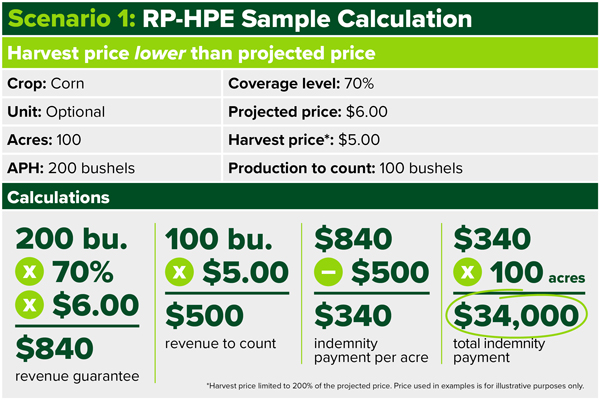

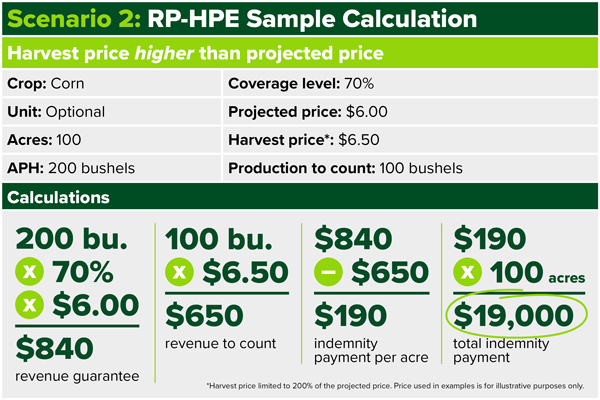

Revenue Protection with Harvest Price Exclusion (RP-HPE) is similar to the RP policy, but the revenue guarantee does not increase if the harvest price is higher than the projected price. However, a benefit to the policy, is that it generally has a lower premium than an RP policy.

Which crop insurance plans require a notice of loss?

Whether or not you are required to report a notice of loss will depend on which crop insurance plan you select. Individual plans — like RP, RP-HPE, APH, and YP — require a notice of loss. That’s because coverage is based exclusively on your operation.

Other coverage options — like area plans or PRF policies — are based on factors outside your operation. As a result, indemnities are paid out when previously agreed-upon conditions are triggered.

No matter which policies you choose for your operation, it’s important to review the actuarial documents and consult with your crop insurance agent to understand reporting requirements.

How does ProAg make crop insurance easy?

It all starts with finding the right agent. We’ve built a network of local independent agents who understand what agriculture is like where you live and work — and a tool to help you find your nearest ProAg agent. It’s just one way we’re committed to making crop insurance easier.

Once you’re a ProAg policyholder, you’ll also be able to access the myProAg® policyholder portal. Accessible on desktop and mobile devices, myProAg is designed to help you manage your policies anytime, anywhere. You’ll be able to pay bills, submit notices of loss, check your claim status and more.

Take the next step

Choose an insurance provider who stands behind you through every season. Find your local independent ProAg agent to explore coverage options.