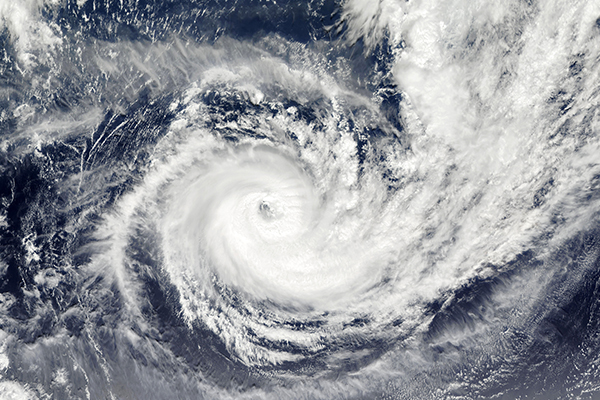

EMERGENCY PROCEDURES FOR CROPS DAMAGED BY HURRICANE HELENE AND CONTINUING IMPACTS FROM HURRICANE DEBBY

Hurricane Helene caused catastrophic damage in Alabama, Florida, Georgia, Kentucky, North Carolina, Ohio, South Carolina, Tennessee, Virginia and West Virginia, in addition to the continuing impacts from Hurricane Debby in Florida, Georgia, North Carolina, and South Carolina. As a result, the Risk Management Agency (RMA) has put emergency procedures in place to streamline certain determinations to help accelerate the adjustment of losses and issuance of indemnity payments to crop insurance policyholders in the impacted areas.

Hurricane Helene caused catastrophic damage in Alabama, Florida, Georgia, Kentucky, North Carolina, Ohio, South Carolina, Tennessee, Virginia and West Virginia, in addition to the continuing impacts from Hurricane Debby in Florida, Georgia, North Carolina, and South Carolina. As a result, the Risk Management Agency (RMA) has put emergency procedures in place to streamline certain determinations to help accelerate the adjustment of losses and issuance of indemnity payments to crop insurance policyholders in the impacted areas.

Normal day-to-day activities in these areas have been and will continue to be disrupted during the recovery period. Communication interruptions and the limited ability to travel in the impacted areas have left many policyholders unable to contact their agents to purchase or make changes to their crop insurance policy or report losses within the Common Crop Insurance Policy, Basic Provisions (BP) 72-hour requirement.

Additionally, many policyholders might not be able to pay their premiums and administrative fees to meet the requirements outlined in Section 24 of the BP and the Special Provisions that state interest will accrue starting the first day of the month, following issuance of the notice of premium due by the Approved Insurance Provider (AIP), provided that a minimum of 30 days has passed from the premium billing date. To ensure policyholders are given adequate time to fully pay their premiums and administrative fees, as part of Manager’s Bulletin MGR-24-006, issued by RMA, procedures were put in place allowing AIPs to provide policyholders who were impacted by Hurricane Debby and/or Helene additional time to make payment of premium and administrative fees. Interest accrual on premium payments and administrative fees, as noted above, will be waived for an additional 60 days of the scheduled payment due date on policies with premium billing dates between October 1, 2024, and November 30, 2024. AIPs will begin to accrue interest after the additional 60-day period for unpaid premium and administrative fees.

AIPs have also been authorized to provide additional time for policyholders to make payment for Written Payment Agreements due between October 1, 2024, and November 30, 2024. Payments may be extended up to 60 days of the scheduled payment due date and considered a timely payment. The extension of time is not considered a modification of the Written Payment Agreement, and the AIP may waive any additional interest for the payment during this 60-day period.

The Manager’s Bulletin also outlines that in accordance with section 18(e)(1) of the BP, policyholders may be able to submit a request for a written agreement after the SCD, but on or before the ARD, if they are able to demonstrate the physical inability to submit the request (or required additional documentation) on or before the SCD.

The bulletin also outlines emergency procedures pertaining to claim and loss adjustments, reporting damage requirements, reporting requirements for Livestock Risk Protection livestock deaths, AIPs having the ability to use reported acres certified on the acreage report as determined acres for claim purposes in some situations, crops destroyed or damaged to the extent they will never be harvested, acres requested to be put to another use, and many other topics of interest to those in the impacted areas.

Lastly, since the issuance of MGR-24-006 on October 3, 2024, RMA received requests for additional emergency loss adjustment procedures and information regarding interest deferral. As a result, MGR-24-006.1 was issued on October 9th outlining additional emergency procedures RMA has authorized AIPs to use for Pecan Tree loss adjustment. Please access the hyperlink above to read the bulletin in its entirety.