Basics of crop insurance

Crop insurance helps protect American farmers and ranchers from the impact of changing markets and unpredictable weather. Coverage is intended to help those in agriculture recover from unexpected financial perils. As a result, farmers and ranchers can continue to provide essential food, fuel and fiber season after season.

Crop insurance policies have been sold in the United States since 1880, though coverage options and subsidies have evolved since then. Today, Federal Multiple Peril Crop Insurance (MPCI) coverage is available through approved insurance providers like ProAg — offering farmers and ranchers access to subsidized standardized policy offerings. Our ProAg team also offers private products for additional or more specific protection.

So, how does crop insurance work? It starts with selecting coverage. The process can feel daunting, so we brought together resources and information to help you understand crop insurance better. Of course, your local ProAg agent is always happy to walk you through the process and answer any questions. Find your nearest independent ProAg agent here.

The federal government has entered a partnership with private approved insurance providers (AIPs), like ProAg, to offer crop insurance to agricultural producers nationwide on an equal opportunity basis. AIPs use independent licensed agents to market this insurance.

Every year, ProAg and other AIPs enter into a contract called the Standard Reinsurance Agreement (SRA) with the Federal Crop Insurance Corporation (FCIC) — an entity under the United States Department of Agriculture that reports to the Secretary of Agriculture. AIPs then administer the crop insurance program by marketing, underwriting and adjusting claims for crop insurance policies. The insurance providers transmit data to the federal government. They are also responsible for both the training and monitoring of agents and staff.

Farmers and ranchers work with crop insurance agents to find the right coverage for their operations, following federally established annual deadlines.

The crop insurance company or approved insurance provider (AIP) agrees to protect the insured (farmer, rancher, grower or beekeeper) against losses that occur during the crop year. Losses must be due to things that are unavoidable or beyond the insured’s control. These could include drought, freeze or disease — among other potential factors. Some policies offer coverage due to adverse weather events, such as the inability to plant due to excess moisture, or losses due to the quality of the crop.

In most cases, the insurance covers loss of yield or revenue exceeding a deductible amount. Farmers, ranchers or growers can experience a loss of revenue due to low production and/or changes in the market price. The types of coverage available vary by crop and county due to the differences in each crop.

It is more accurate to refer to commodities rather than crops when discussing crop insurance since many coverages are not for crops in the typical sense. Over 100 commodities are insured such as perennials (crops not planted every year such as apples, citrus), livestock (cattle, lambs), apiculture (beekeeping), clams, rangeland, pasture and oysters.

Some crops can be insurable under numerous plans. For example, wheat coverage includes Yield Protection (YP), Revenue Protection (RP), Area Yield Protection (AYP) as well as numerous other crop insurance plans; whereas a crop of wine grapes can only be insured under a yield-based plan of insurance (Actual Production History – APH).

The types of coverages vary by crop due to the difference in the crop’s individual natures. Imagine the different requirements in the following crops: corn, wheat, blueberries, cabbage, cucumbers, figs, mint, olives and nursery plants.

A plan of insurance is a specific type of insurance that is offered, including all the rules associated with it. In most cases, a crop may be insured by only one plan at a time. When multiple plans are available, the producer must review the coverage details within each plan and select the one that best fits his or her farming operation and risk management needs. Crop insurance agents are responsible for knowing the plans available in the agent’s marketing area and the requirements for each plan.

The number of insurable crops and types of crop insurance continues to grow to meet the increasing needs of the farmer. A list of insurable crops can be found within the Actuarial Information Browser on the RMA website. It is essential for agents to be aware of and review all options available to producers in their state and county and to provide the insured with information regarding all products available to them.

Federal crop insurance is commonly referred to as Multiple Peril Crop Insurance or Multi-Peril Crop Insurance (MPCI) throughout the industry. For more details about specific policies visit our MPCI page.

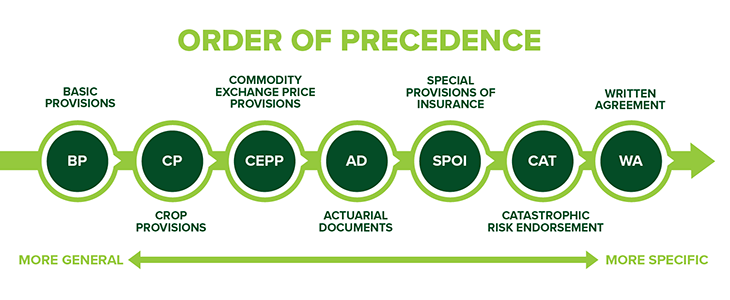

Crop insurance has many supporting documents. Below is a list of policy provisions (rules) that are necessary to address all the facets of the Common Crop Insurance Policy. As you move to the right, the information gets more specific. For example, the Basic Provisions contain general crop insurance information regarding what options are available. Crop provisions provide crop-specific information since not every option applies to every crop. The actuarial documents are even more specific, including county-specific details.

Premium rates and insurance terms and conditions are established by the Federal Crop Insurance Corporation (FCIC) for the products it develops. There are also products developed by insurance providers and established with FCIC approval. In both cases, the price of insurance is constant throughout the industry. In other words, the cost is the same regardless of the crop insurance company or agency. Companies and agencies compete with crop insurance knowledge, customer service and related insurance products. The agent’s ability to build business relationships with the insured is an important piece of the delivery system.

Agents are involved in the sale and service of crop insurance. The program includes multiple plans of coverage for over 100 crops or commodities. With many crops and plans in place, the program guidelines change frequently.

The crop insurance agent receives a commission, outlined in an annual contract between the agent and the insurance company. In return, the agent provides product and premium information to the insured and collects information from the insured as required by the policy throughout the year.

Policy information often varies by crop, from state to state and sometimes from county to county. Therefore, the policy is made up of many parts. There are documents that address the commonalities and other documents that address the differences. A lot of the information changes from year to year, and sometimes month to month. An agent is responsible for understanding the crops and plans in their specific region.

The insured, or policyholder, is the farmer, rancher, beekeeper or grower who takes out the type of crop insurance policy for the crop that he or she has ownership over or a substantial beneficial interest (SBI). The insured enters into a contract to insure a crop in a county where insurance is available. The insured is the main focus of the crop insurance program. Providing the ag producer with tools to manage risk is the primary goal of the Federal Crop Insurance Program — and of the ProAg team.

The insured’s responsibilities include reporting specific information to establish a contract and guarantee, paying all applicable premiums and fees, following appropriate farming practices, and notifying the approved insurance provider (AIP) in the event of a loss.

An indemnity (or loss payment) is issued to the insured when the requirements of the policy have been met. In most cases, the crop has not produced enough and/or generated enough revenue due to an insurable reason or cause of loss.

Planted crops with damage or loss of production: A notice of loss for a planted crop must be provided within 72 hours of the initial discovery of damage or loss of production (but no later than 15 days after the end of the insurance period, even if the crop has not been harvested).

Revenue loss without a production loss: If there is no damage or loss of production and a revenue plan of insurance is in effect, notice must be given no later than 45 days after the latest date the harvest price is released.

Prevented planting: For crops that are prevented from being planted due to an insurable cause of loss (for example, a flood) notice must be provided within 72 hours after the final planting date or the time the producer determines it is not possible to plant during any applicable late-planting period.

End of late planting period: The late planting period usually begins after the final plant date and it lasts for 25 days. Please refer to the actuarial documents Dates or Special Provisions tab for specifics by crop and area.

Ready to dive in deeper?

Multiple Peril Crop Insurance (MPCI) provides protection from a variety of naturally occurring perils or hazards. The Crop Provisions for each crop lists the covered causes of loss specific to that crop. Although crops vary somewhat, most provide coverage against the following:

- Adverse weather conditions

- Fire

- Insects*

- Plant disease*

- Wildlife

- Earthquake

- Volcanic eruption

- Failure of the irrigation water supply, if applicable, due to an unavoidable cause of loss occurring within the insurance period.

*Does not include damage due to insufficient or improper application of insect or disease control measures.

Most federal crop insurance policies provide coverage for loss of production or yield. Some plans combine yield and price coverage. These plans cover loss in value due to a change in market price during the insurance period in addition to the perils covered by the standard loss of yield coverage.

Crop insurance policies also typically indemnify (protect) the insured from other adverse events, such as the inability to plant (referred to as prevented planting or PP) or excessive loss of quality due to adverse weather. These coverage types vary by crop due to the difference in the crop’s individual natures.

A plan is a type of insurance coverage. In this section, we will review a few of the more common plans of insurance, including their coverage levels and pricing.

- Individual plans are based on the insured’s individual production or yield history, revenue or both.

- Area plans are based on information from the entire county, using averages from surrounding ag producers.

- Additional plans of insurance are available in some states and counties. It is important to review the actuarial documents for all plans of insurance in your area. Examples include livestock coverage, pasture, rangeland, and forage coverage, and apiculture (beekeeping) coverage.

Download our crop insurance comparison guide

Individual Plans of Insurance – Based on a Farmer’s History

Here are some of the more common individual plans of insurance. Additional plans may be available in certain states or counties.

Actual Production History (APH)

The Actual Production History (APH) plan of insurance is the oldest federal crop insurance plan available. It provides the producer protection against a loss of production (how much the crop produces) due to nearly all unavoidable, naturally occurring events. This type of crop insurance guarantees the farmer a yield based on the actual production history of his or her crops, which is why it is called the APH plan.

The guarantee is calculated by multiplying the average yield by the coverage level elected for the farmer’s share of the crop. An indemnity (loss payment) may be due if the production (harvested and appraised) is less than the guaranteed amount.

The pricing for most crops insured under the APH plan of insurance is established by RMA. These prices are called price elections and are posted online.

Crops that do not have revenue coverage available and many perennial crops (crops that are not planted every year) — such as apples, peaches or grapes — fall under the APH plan. Some grain crops such as oats, rye, and buckwheat are also covered under the APH plan of insurance.

Actual Revenue History (ARH)

The Actual Revenue History (ARH) plan is based on the insured’s revenue history for the crop that is insured. The guarantee amount is calculated based on the insured’s production and revenue history. A loss occurs when the revenue to count for the current year falls below the insured’s guaranteed revenue.

Yield Protection (YP)

The Yield Protection (YP) plan is very similar to the APH plan but is only available on crops that are eligible for Revenue Protection. The Yield Protection plan of insurance provides protection against a loss of production.

It works the same as the APH plan but instead of using a price election established by RMA, the price is established according to the applicable board of trade/exchange as defined in the policy document called the Commodity Exchange Price Provisions (CEPP). The price used is called the Projected Price. The Projected Price is used to calculate the guarantee, premium and loss payments.

The guarantee is established by multiplying the average yield by the coverage level and by the Projected Price, and an indemnity may be due when the value of the production to count is less than the yield protection guarantee plan.

Revenue Protection (RP)

The Revenue Protection (RP) Plan provides protection against a loss of revenue caused by price increases, price decreases (loss of production), or a combination of both. It is available for the same crops where YP coverage is available.

The RP plan uses CEPP to establish the pricing. Unlike the YP plan, it uses two different price discovery periods. The projected price is determined in the same manner as YP and is used to calculate the premium, replant and prevented planting payments. The harvest price is released near harvest time. This price is used to calculate an indemnity.

The revenue protection guarantee is established by: (Average Yield) X (Coverage Level) X (Insured’s Share Percentage) X (Projected Price).

An indemnity may be due when the calculated revenue (insured’s production multiplied by harvest price) is less than the revenue protection guarantee for the crop acreage.

NOTE: When the harvest price is released, if it is greater than the projected price, the revenue guarantee is recalculated using the harvest price.

While the revenue guarantee is increased, the insured is not charged an additional premium. If the harvest price is less than the projected price, the policy guarantee remains at the projected price.

Losses are paid using the harvest price.

Revenue Protection With Harvest Price Exclusion (HP-HPE)

The Revenue Protection Plan with Harvest Price Exclusion Plan (RP-HPE) is similar to the Revenue Protection (RP) plan, however it provides coverage against loss of revenue caused by price decrease, low yields or a combination of both – the price increase is not covered because the guarantee is not adjusted up by the harvest price for this plan.

The projected price is used to determine the revenue guarantee, the premium and any replant or prevented planting payment. The harvest price is only used to value the production to count in a production or revenue loss. It is not used to recalculate the guarantee if there is an increase.

The farmer does not receive the benefit of price movement with the RP-HPE plan.

Dollar Plans of Insurance

Dollar Plans of Insurance are available for some commodities. Dollar Plans of Insurance are usually insured in dollar per acre or some other measurement applicable to the crop. The maximum dollar amount per acre or other measurement is established and published by RMA. The insured chooses a percentage of the maximum dollar amount to establish the guarantee. A loss occurs when the dollar to count per acre falls below the dollar amount of insurance.

Area Plans or County-Wide Insurance Plans

Area Crop Insurance Plans insure against an area-wide — usually county-wide — loss of production on a crop. When an entire county’s crop yield is low, most farmers in the county will also have low yields. National Agricultural Statistical Service (NASS) county data is used to set the expected and actual county yields.

Under an area plan, the insured chooses a percentage of the expected county yield or revenue published by RMA in the actuarial documents. If the actual county yield or revenue falls below the expected county yield, a loss occurs.

The individual plans of insurance (Actual Production History (APH), Yield Protection (YP), Revenue Protection (RP), and Revenue Protection with Harvest Price Exclusion (RP-HPE)) all require the farmer to provide the amount of past production so a guarantee can be established. Even though a farmer’s actual yields are not used to establish a guarantee for area plans, the Area Risk Protection Insurance (ARPI) plan still requires the production to be reported at the end of the insurance period. Maintaining this production history is mandatory and may be used by RMA as a data source to establish and maintain these area programs.

Area Risk Protection Insurance (ARPI) was established in 2014 and is the newest Area Plan of Insurance. ARPI has its own Basic Provisions, separate from the Common Crop Insurance Policy, so all ARPI plans of insurance follow these different guidelines.

There are three ARPI Plans of Insurance:

-

Area Yield Protection Plan (AYP)

- The Area Yield Protection Plan (AYP) plan provides coverage based on the experience of the county, rather than an individual farm. A loss may occur if the final county yield falls below the insured’s expected (or trigger) yield. The Federal Crop Insurance Corporation (FCIC) issues the final county yield in the calendar year following the insured crop year. Since this plan is based on a county yield and not a farmers’s individual yield, it is possible for a producer to have a low yield on the farm and not receive any payment under this plan.

-

Area Revenue Protection (ARP)

- The Area Revenue Protection Plan (ARP) provides the yield protection of the Area Yield Protection Plan with the protection against a loss of revenue due to production loss, price decline or a combination of both. ARP is similar to the RP plan, as the initial guarantee is calculated using the projected price. However, the ARP revenue guarantee increases if the harvest price is greater than the projected price. If the harvest price is lower than the projected price, the policy guarantee remains the same. A loss occurs when the Final County Revenue falls below the Expected County Revenue (or Trigger) Guarantee.

-

Area Revenue with Harvest Price Exclusion (ARP-HPE)

- The Area Revenue with Harvest Price Exclusion (ARP-HPE) Plan is similar to the ARP plan except the guarantee is not adjusted up by the harvest price. The guarantee is always based on the projected price, but losses are calculated using the harvest price. This plan is very similar to the RPE-HPE plan except it is based on the experience of the county, rather than the individual farmer.

ARPI has both a projected price and a harvest price. The prices are established using the same methodology as the YP and RP plans according to the applicable commodity board of trade/exchange as defined in the CEPP. Written agreements are not available for any of the ARPI plans of insurance. For more information on how ARPI plans of insurance work, refer to the RMA website www.rma.usda.gov and review the ARPI basic provisions along with any applicable ARPI crop provisions.

What is crop hail insurance and what does it cover?

Crop insurance that is not part of the federal program is referred to as private product crop insurance. Most private product coverage may be added to a crop to supplement coverage under federal crop insurance policies. Some plans even require a federal crop insurance underlying policy. There are several other types of private product crop insurance depending on the growing area and crops. Most private product coverage is on an acre-by-acre basis. Production reports are usually not required. The liability is usually expressed in a dollar amount instead of a production guarantee.

One of the most common private product crop insurance types is crop hail insurance, which primarily covers damage to crops caused by hail. However, it can also provide coverage for a few other things, such as transit or storage coverage and vandalism.

Unlike MPCI, crop hail premiums are often due at the time of application or by a certain date following application.

Losses are paid when damage by the specified peril occurs to the crop.

Agents, please contact your ProAg sales district manager to review ProAg crop hail insurance and other private products available in your area. Insureds, contact your local ProAg agent to see what options are available to you.

Why is unit structure important?

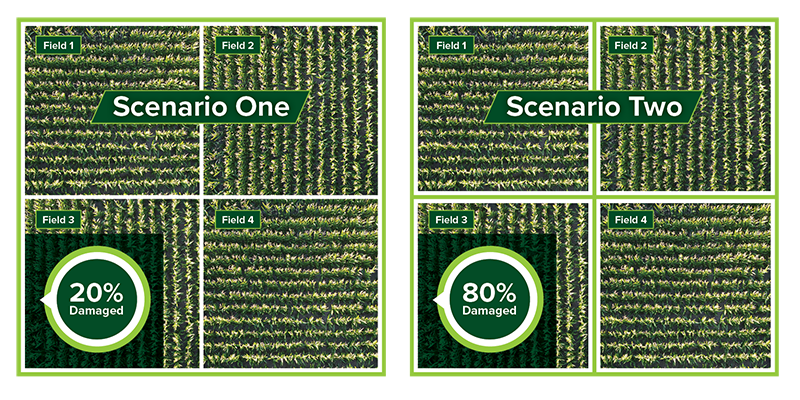

A unit describes how crop acreages are grouped together for crop insurance coverage. Unit structure simply refers to the way a farmer chooses to group his or her fields. For example, one type of unit structure allows the farmer to have all fields or acreage placed into one group or unit. Another type of unit structure allows a farmer to have separate units or groups for each field or location.

Claims are paid based on the total yield or production for a specific unit. If the insured has elected to group all the fields, production or yield is considered as a whole. If smaller groups are elected, each smaller unit is looked at individually. This increases the chances of a claim payment.

There are rules surrounding how acreage is grouped, as well as how unit structure can affect the premium. Discounts are available for some elections. Generally speaking, the more an acreage is broken up, the higher the chances of a claim payment and the higher the cost of the premium.

EXAMPLE:

A farmer has four fields. One field is damaged due to a storm.

Scenario One: If the farmer groups four fields together and only one field is mostly damaged, the total loss may be around 20 percent. Since only one out of four of the fields were damaged, it is highly unlikely that the insured would receive an indemnity for that one damaged field.

Scenario Two: The farmer chooses not to group all fields. Each field is seen as a separate unit, for a total of four separate units. Three units have no damage, but one unit has 80% damage. It would be much more likely the insured would be indemnified for that one damaged field in this scenario.

Depending on how much coverage the farmer elects, he/she could receive a claim check for one scenario but not the other.

There are five different types of units, each with a specific code to help with easier identification:

- Basic Unit (BU)

- Optional Unit (OU)

- Enterprise Unit (EU)

- Enterprise Unit by Practice (EP)

- Whole Farm Unit (WU)

Basic Units (BU)

Basic units include all insurable acreage of a specific crop in a specific county in which the insured has a share. However, each share arrangement (different shareholders) is a different basic unit and cash rented land (land that is rented and utilized as if one owns it) and land actually owned are considered to be the same and are therefore all part of the same basic unit.

In order to qualify for another basic unit, there would need to be a different sharecrop arrangement with a different landlord if applicable.

NOTE: Different share percentages with the same landlord do not qualify for additional basic units.

Optional Units (OU)

Optional units can be established by location, type of crop or method of farming practice. This could vary by crop and region.

NOTE: Some crop provisions also allow optional units by variety, type, and non-contiguous land.

Enterprise Units (EU)

Enterprise units consist of all insurable acreage of the same crop in the county in which the insured has a share on the date that coverage begins for the crop year. This means ground with 100% share and ground that is sharecropped are grouped together if in the same county. Because all acreage of the crop is grouped together, the losses may not be as large compared to basic or optional units. However, there is a significant premium discount for enterprise units.

Enterprise Units by Practice (EP)

When available, insureds have the option to select enterprise units by practice for the same crop if both non-irrigated and irrigated practices exist on the policy for the crop in which enterprise unit structure was elected. The insured may have an EP for one practice and a different unit structure for the other practice. In order to select EU by practice, the acreage must meet the EU requirements and it must be allowed by the actuarial documents.

Whole Farm Unit (WU)

This is the least common type of unit structure. Whole farm units are exactly what the name implies. Whole farm units consist of all insurable acreage of all crops in the county in which the insured has a share.

NOTE: This is not related to the Whole-Farm Revenue Protection (WFRP) plan of insurance.

Just starting your crop insurance career? Interested in a “Crop Insurance 101”? ProAg offers Intro to Crop Insurance webinars throughout the year for ProAg agents and affiliates. Each attendee will receive a guide, a workbook, and reference materials designed to save time. During this course, expect to work through live examples of completing applications, production reports, acreage reports, and more. Though this is an intro course, it is designed to include content to assist in the ease of doing business. Agents and processors of all experience levels are encouraged and welcome to join. Log into the ProAgPortal®intranet and register today for these important classes.

Crop insurance is a vital part of the American agricultural industry and a key risk management tool for the modern farmer. It is, however, a complex topic, so we would like to provide an overview of some of the basic crop insurance concepts, practices, and tools. We hope this will be informative to those who are seeking a basic understanding of crop insurance, while also serving as a resource for those better acquainted with the topic.

As you can imagine, the crop insurance industry is filled with acronyms and terms. Please check out our crop insurance Acronyms page for additional basic explanations.

This is a summary only and is meant to provide basic information for general informational purposes only. In no way should it be considered a replacement to any federally published policy, provision, underwriting handbook or loss handbook language.

Current agents: Go to ProAgU to complete the expanded Crop Insurance 101 course and earn your RMA hours.

Agent Crop Insurance 101 Course

Not a ProAg agent? Join us now to access this and other resources from ProAg.

For more than 90 years, ProAg has provided personal service to farmers and agents. ProAg began as a family-owned business located in Amarillo, TX, and has evolved into a visionary, privately-owned business dedicated to outstanding quality and performance in agriculture risk management.

ProAg, a member of the Tokio Marine HCC group of companies, is positioned as a financially strong and well-capitalized insurer prepared to weather any economic storm. We strive to serve our clients’ best interests by remaining singularly focused on our specialized line of business—crop insurance. We stand committed to continuing the principles that ProAg was founded on: Integrity, Loyalty and Customer Service. ProAg is dedicated to helping our trusted agent partners grow by our continued commitment to innovative technologies such as mapping, precision ag, automated weather products and in-the-field adjusting.

Above all, ProAg is dedicated to building strong and secure relationships. We believe long-term business partnerships with farmers, agents, and reinsurers (some of which span five decades) allow us to deliver a consistency of service unmatched in our industry. We value the large and small agent, as well as the family and corporate farmer.