Harvest, Trade Woes Weigh on Attitudes

Anyone wondering how long, wet and miserable the 2018 fall harvest was only has to peer at the results of the latest DTN/The Progressive Farmer Agriculture Confidence Index.

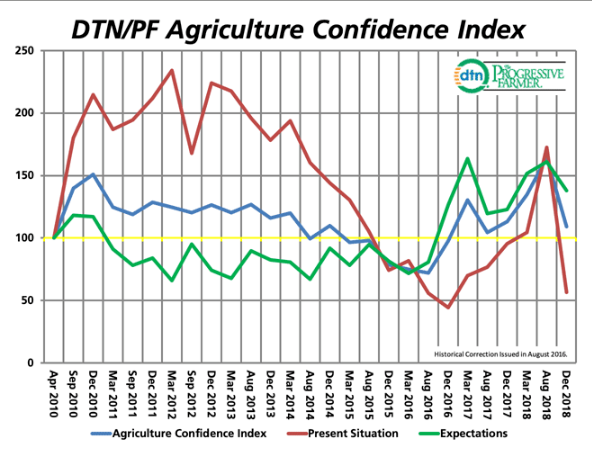

Results from farmers surveyed in early December saw the index drop more than 50 points, from the record-setting 164.8 found just prior to harvest, to an essentially neutral 109.2. When asked how they felt about their current conditions, the real negativity came through.

The DTN/The Progressive Farmer Agriculture Confidence Index is conducted three times a year: Early spring before planting; August, just prior to harvest; and just before the end of the year, during tax preparation time. The telephone survey is conducted with at least 500 farmers who identify as being actively engaged in the farm operation.

Farmers were surveyed from Dec. 4-15. This was just prior to confirmation soybean producers would receive a second round of tariff-compensation payments. The pre-harvest survey was conducted just as farmers were getting the good news about the first round.

Farmers responding to the telephone survey answer a series of financial and income questions that compare the present to how they expect conditions to be in the coming year. A score is given to rate their “present situation” and to their “future expectations.” Those numbers are combined to create the overall Agriculture Confidence Index.

Index levels above 100 are considered optimistic compared to baseline scores when the Index began; scores less than 100 are viewed as pessimistic versus the baseline.

When you pick apart those “present situation” and “future expectations” scores, the real story of the winter 2018 survey comes out.

Farmers rated their present situation at a woeful 56.5, down a record-setting 115.9 points from pre-harvest, and down nearly 40 points from a year ago.

“Put in the context of current events and conventional wisdom, it’s not surprising that the long, wet, difficult harvest and the backlog of corn and soybeans due to trade disputes are weighing on farmers’ minds,” said Robert Hill, economist and original designer of the ACI.

“These are the toughest conditions they have dealt with in almost a decade, on the backs of continued lower commodity prices.”

Comparing the present situation index to winter 2017 reveals a whopping 41% drop, Hill said. Looking at answers to specific question shows “farmers are upset over current input prices and current farm income,” he said. “In just 12 months, the present situation has lost almost half of its value. That is a remarkable turn in sentiment.”

Somewhat of a flipside to that pessimism is seen in how farmers described their future: Producer answers created a future expectations score of 138. It is still a significant drop, by 23.1 points, from pre-harvest ratings, but is 15 points above the expectations they held in December 2017.

“Farmers think that input prices will on balance be better next year, that their farm income will be better, and that their household incomes will improve,” said Hill. “It is unclear to economists in this industry exactly how the farmer optimism about the future is justified. It is confounding that future optimism is improving at the same time the current situation has collapsed so precipitously.”

Looking at survey scores by region and by type of enterprise showed similar patterns. Midwest farmers — those affected most by poor harvest conditions and by trade-dispute issues — saw the sharpest drops, with an overall index down 59.2 points, to 103.4. Their present situation score was a pessimistic 35.4, down 120 points from pre-harvest levels. Crop farmers scored an overall Index of 113.9, down 58.l from August. Livestock producers put overall conditions at 97.9, down 50.8 from August and down 14.7 from December 2017.

Crop farmers were more optimistic about the future: Their expectations score was 148.9; livestock producers scored a more neutral 113.5.

Farmers certainly are not willing to do “business as usual” with their suppliers, said Hill, who also works closely with a number of ag retail and supplier clients. Farmers appear off their conventional input purchasing patterns, ignoring financial incentives of early order and prepay discounts traditionally offered by suppliers, he said.

“This is causing a chain reaction of uncomfortable uncertainties for the ag supply industry not seen for several decades.”

In addition to the survey of farmers, DTN/The Progressive Farmer also conducts a similar query of at least 100 ag retailers for the DTN/The Progressive Farmer Agribusiness Index. Scores around that index are flat to up only slightly: The overall Index is 107.3, up 11.7 points from pre-harvest and 6.6 points from 2017. Agribusiness owners put their present situation at 109, a point lower than pre-harvest; they rated future expectations at 105, back into neutral territory from the 84 before harvest and less than five points above 2017 levels.

Despite the somewhat neutral scores, Hill said the uncertainty over plantings and purchases is making everyone in the supply sector, from manufacturers, wholesalers to retailers “very nervous.”

“There are very high uncertainties about acreages to be planted, whether to rent land, what seed traits make sense to pay for, what weed control program to use, and on and on.”

The next round of surveys for the DTN/The Progressive Farmer Agriculture Confidence Index and Agribusiness Index will be in April.

To see a Reporter’s Notebook video about the latest results, see https://www.dtnpf.com/…

Greg D. Horstmeier can be reached at greg.horstmeier@dtn.com

Follow him on Twitter @greghorstmeier

Source: Greg Horstmeier, DTN