Federal Crop Insurance Options and 5 Things to Know About ECO + AIM

Target YOUR Individual Farm with ECO + AIM

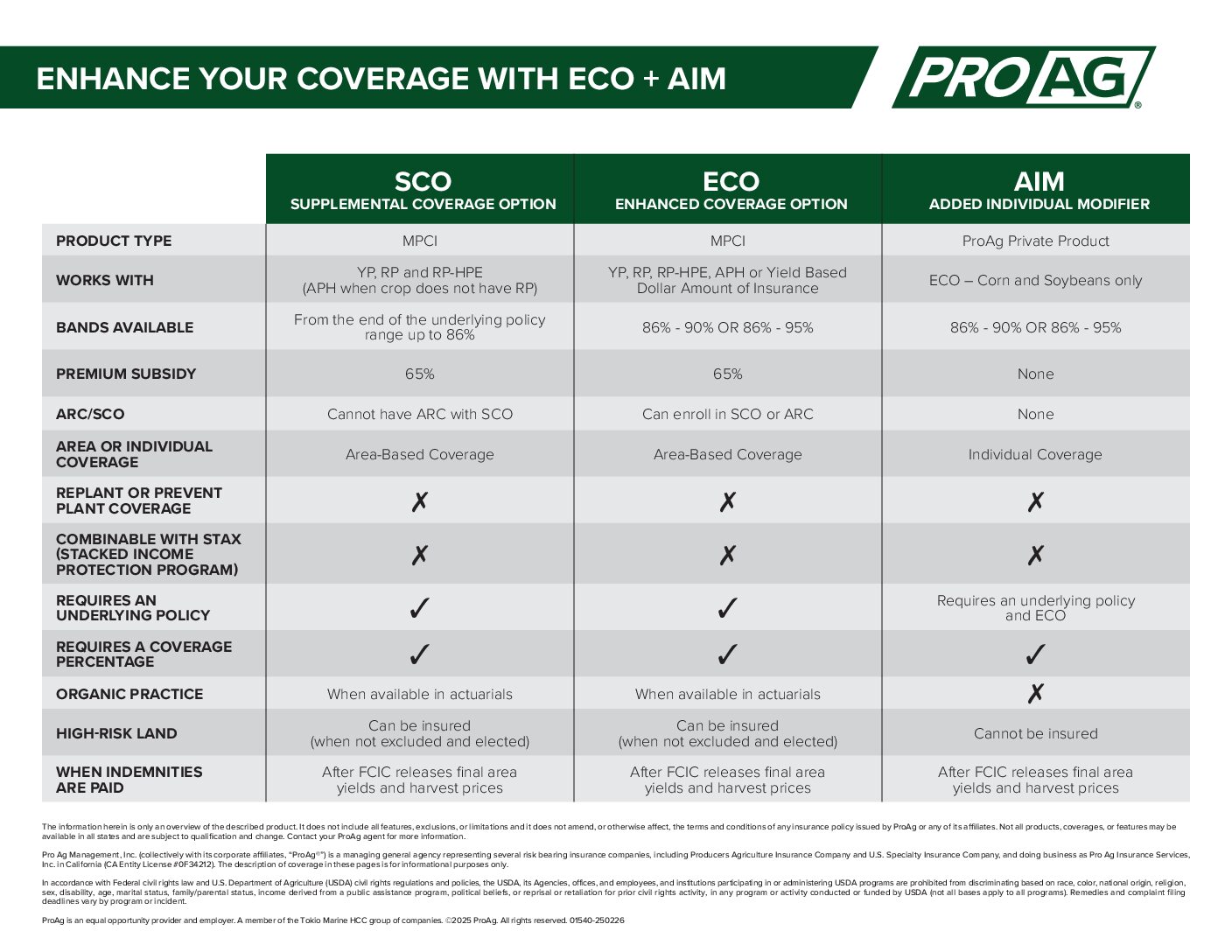

The Enhanced Coverage Option (ECO) is an area-based federal crop insurance policy option approved by the U.S. Department of Agriculture (USDA) Risk Management Agency (RMA) and available from ProAg that extends existing multiple-peril crop insurance (MPCI) coverage. Now, an additional private product, exclusively available from ProAg – Added Individual Modifier (AIM) – takes that enhanced protection even further.

The ECO option covers a portion of the policy deductible of an underlying federal crop insurance policy. It can be added to MPCI yield and revenue policies and provides coverage trigger levels of 90% or 95%.

ECO offers coverage in addition to an MPCI policy. But it’s not a cure-all. Since it’s area-based, eligible producers can still experience localized crop losses without receiving an indemnity. That’s where ProAg’s Added Individual Modifier (AIM) coverage option comes in. The exclusive, individualized policy option extends ECO coverage at harvest to include properly documented, specific farm-level harvested production results, as opposed to area-based results, in states where AIM is available.

An AIM Policy is a private policy* and is not subsidized or reinsured by the Federal Crop Insurance Corporation.

What to know about these new crop insurance coverage options

Here are five things to know about AIM — available to corn and soybean producers in eligible states — and how the combination of ProAg AIM and ECO provide an industry-leading level of crop insurance protection.

- The combination of AIM and ECO provides two coverage triggers. Since the ECO program is area-based, insurance indemnities are triggered and paid on that basis. But AIM indemnities are based specifically on conditions on your farm. So, while ECO will provide coverage for area-wide issues like drought or flooding, AIM looks at how those issues affect your specific acres and also provides farm-level coverage for localized issues like hail and windstorms. That makes ECO and AIM a one-two punch for covering any potential crop losses from both area-wide and farm-specific covered perils.

- The AIM and ECO policy options calculate crop losses differently. At harvest, ECO uses RMA’s final federal crop insurance county average yields as the basis for indemnity payments, while AIM indemnities are based on your farm’s individual harvested production. Verifiable production records for each insured detail line must be kept according to underlying policy rules and requirements to qualify for AIM indemnities.

- The ECO and AIM options work together to cover losses. Just because you get an ECO indemnity doesn’t mean you’ll get one from AIM, and vice versa. Partial payments from both options are also possible based on documented production. When used together, any ECO indemnity is subtracted from the individualized potential AIM indemnity to determine the final payable AIM indemnity. The combined value of the supplemental coverages provided by the AIM policy and the ECO Endorsement along with the underlying MPCI policy coverage and any resulting indemnities may not exceed the value of the Approved Yield multiplied by the MPCI price election.

- These two policy options have THE SAME payment windows. ECO and AIM indemnities are paid the following March / April after RMA has released the prior year’s final average harvested county yields and revenues.

- There are areas where ECO and AIM is a better fit. Growers in regions where both area-wide issues, as well as individual-based coverages, are of importance would be likely candidates for ECO + AIM. Farmers in areas that have localized disasters, like damaging wind or hailstorms, also stand to benefit from both ECO and AIM.

Start here if you’re interested in adding ECO and AIM coverage to your farm. If you’re ready to add the policy option, contact a trusted ProAg agent.

* Not all coverage or products may be available in all jurisdictions. The description of coverage in this article is for informational purposes only. Actual coverage will vary based on the terms and conditions of the policy issued. The information described herein does not amend, or otherwise affect, the terms and conditions of any insurance policy issued by any of ProAg’s affiliated insurance companies.