Unexpected decline in milk revenue? We’ve got you covered.

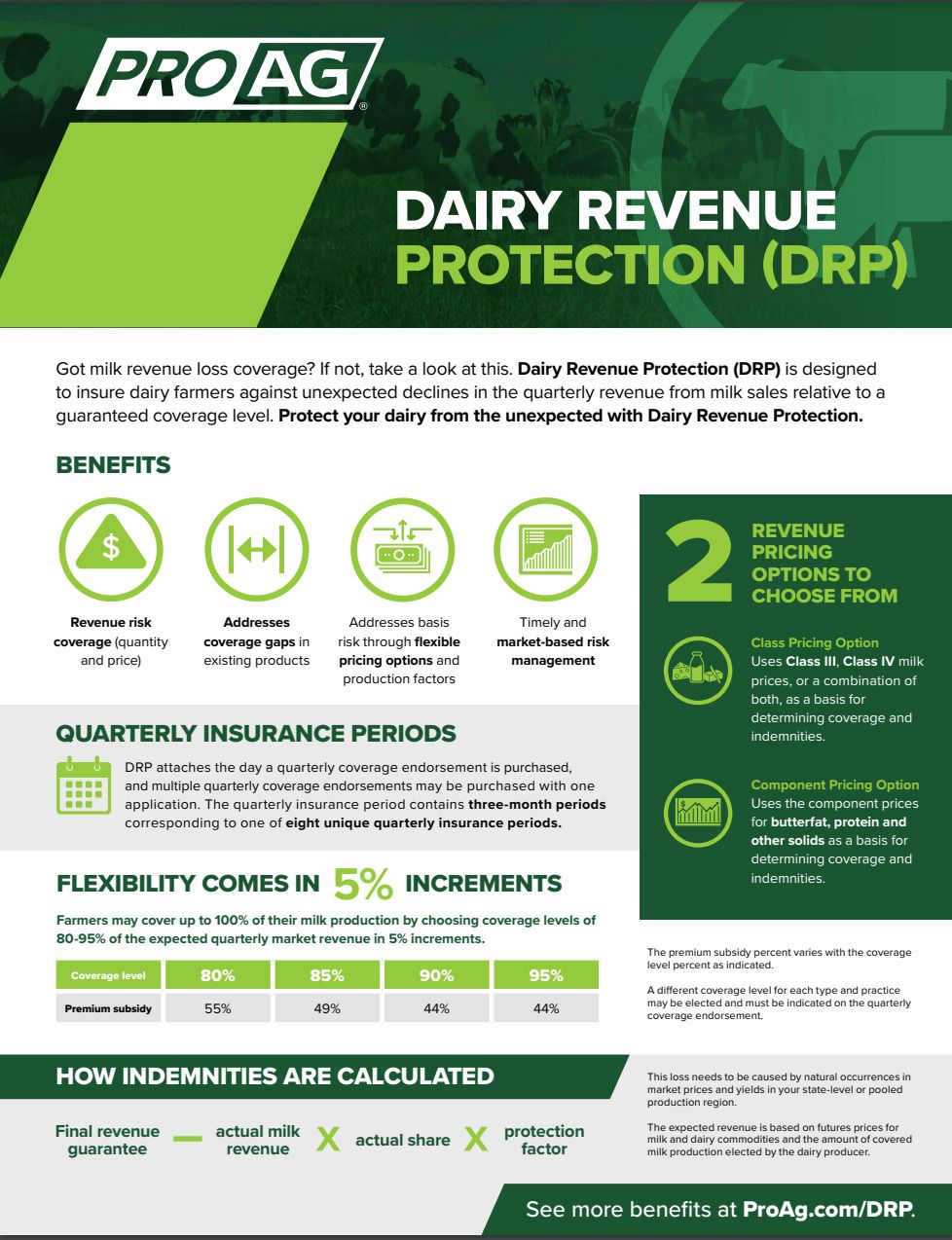

ProAg Dairy Revenue Protection (DRP) is a great peace-of-mind policy for all dairy farmers. DRP is designed to insure against unexpected declines in the quarterly revenue from milk sales. Producers may cover up to 100% of their milk production by choosing coverage levels of 80-95% of the expected quarterly market revenue in 5% increments. The expected revenue is based on futures prices for milk and dairy commodities and the amount of covered milk production elected, and the covered milk production is indexed to a state or region based upon location.

Policy benefits to dairy producers include:

- Addresses basis risk through flexible pricing options and production factors

- Easy-to-use online quoting with the myProAg™ policyholder portal

- Revenue risk coverage (quantity and price)

- Timely and market-based risk management

- Addressing coverage gaps in existing products

Updates for 2023:

- Allow sales to be suspended during the sales period for situations that arise during the sales period in which market conditions adversely change after the fact.

- Add flexibility to continue coverage when producers experience a disaster at their dairy operation. The insured can use the milk marketing records as of the date of the disaster to determine the milk produced for the rest of the insurance period or use prior milk marketing records if the disaster occurs prior to the start of the insurance period.

- Revised the policy to clarify that the termination date is June 30. Cancellation during a crop year to submit an application for another DRP policy with a different insurance provider within the same crop year is not allowed.

- Clarified that an insured cannot have other livestock insurance on the same milk in the same quarterly insurance period.

Contact a trusted ProAg agent for more information about Dairy Revenue Protection.

Ready to fill your glass with DRP? Get started with these resources!

Have questions? Check out our handy guide for all things DRP.