COVID-19 Continues to Impact Farmer Sentiment

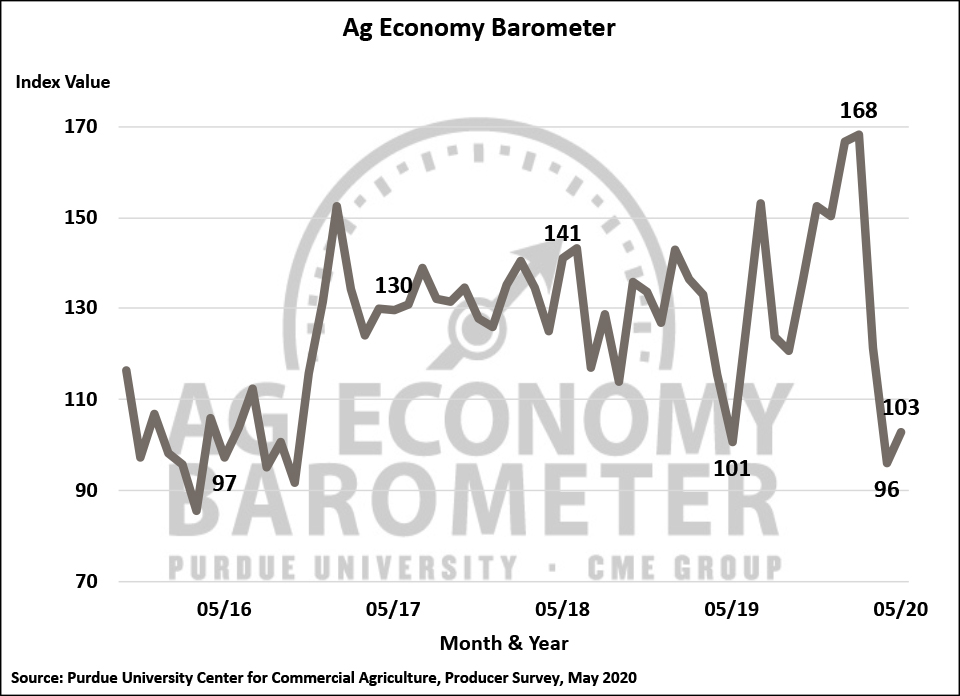

Farmer sentiment improved slightly in May after falling sharply in both March and April. The Purdue University-CME Group Ag Economy Barometer reading in May was 103, up 7 points from the April reading of 96. The barometer’s small improvement left the gauge of farmer sentiment nearly 40 percent below its February peak of 168. This month’s survey also indicated that farmer sentiment was virtually unchanged from May 2019 when the index reached its lowest reading of 2019 as U.S. farmers were in the midst of struggling through a historically difficult spring planting season. The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from May 18-22, 2020. USDA announced the details of the Coronavirus Food Assistance Program (CFAP) on May 19, while the May survey was being conducted.

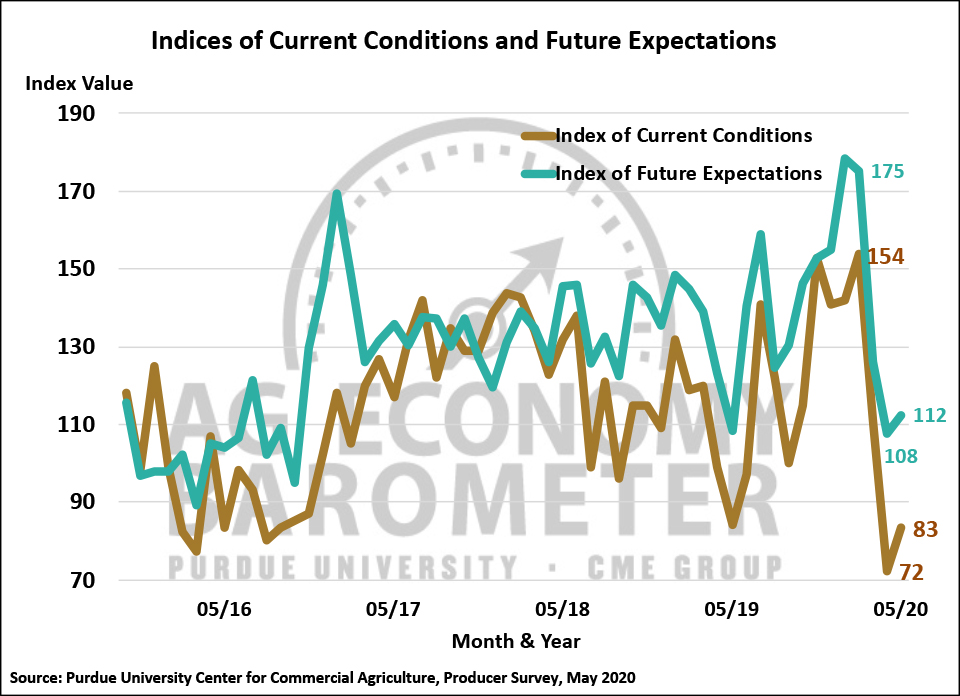

The modest improvement in farmer sentiment was attributable to increases in both the Current Conditions and Future Expectations indices. The Current Conditions Index rose 11 points during May to a reading of 83 whereas the Index of Future Expectations rose just 4 points to a reading of 112. The improvement in the Index of Current Conditions was probably motivated in part by increasing awareness of details regarding payments farmers are likely to receive under CFAP for losses incurred during the first two quarters of 2020. However, despite the 15 percent improvement in farmers perception of current conditions on their farms, the May Current Conditions Index reading was still 46 percent lower than three months earlier.

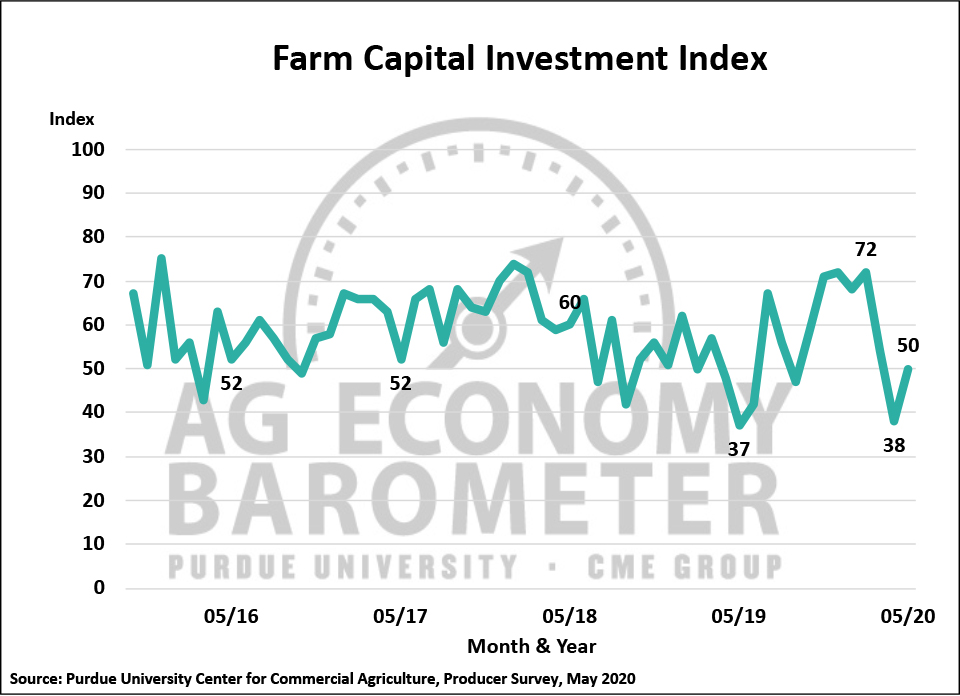

Improved sentiment regarding current conditions led farmers to become more inclined to think now is a good time to make large investments in their farming operations than in April. The Farm Capital Investment Index rose to a reading of 50 in May compared to just 38 a month earlier. Although that was a substantial one-month improvement, it still left the index 30 percent below its February reading of 72 indicating farmers are still much more reluctant to make new investments in things like farm machinery and buildings than they were prior to the onset of COVID-19.

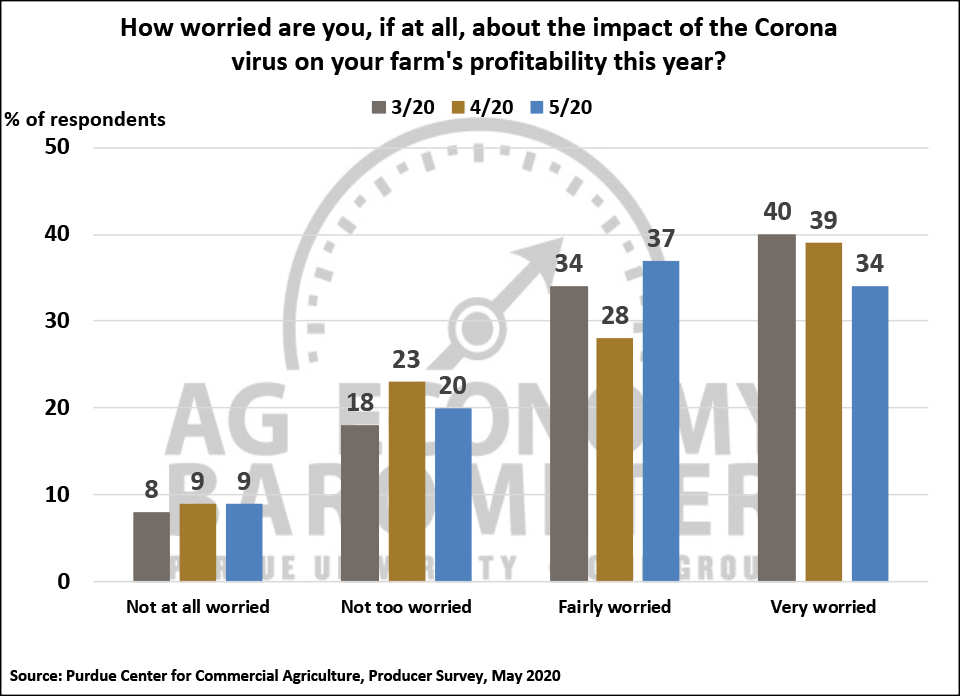

Although overall sentiment improved during May, farmers continue to be concerned about the impact of coronavirus on their farms. Over 70 percent of farmers responding to our May survey said they were either very worried (34 percent) or fairly worried (37 percent) about the impact of coronavirus on their farms’ profitability, up somewhat from a month earlier when two-thirds of respondents expressed concerns about the virus impact on their farms. The top two concerns among farmers about the virus impact on their farms continue to be market access (42 percent) and financial (39 percent) with health and safety (11 percent) a distant third. Finally, two-thirds of farmers in the May survey said they think it will be necessary for Congress to pass another bill to provide more economic assistance to U.S. farmers.

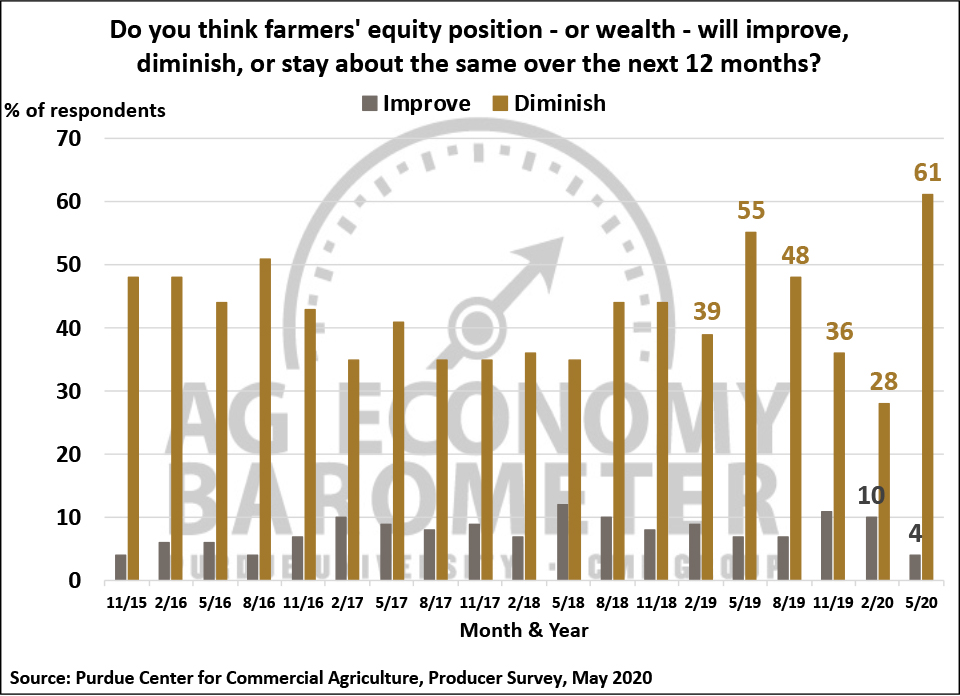

Farmers concern about their financial position, and the impact coronavirus is having on their operation, was evident when asked what they expected to happen to farmers’ equity or wealth over the next year. Sixty-one percent of respondents to the May survey said they expected farmers’ equity to decline over the next 12 months. When this same question was last posed in February 2020, just 28 percent of farmers said they expected farmers’ equity to decline in the upcoming year. This also marked a dramatic reversal of a trend of farmers becoming more optimistic regarding farm finances that was in place going back to mid-2019.

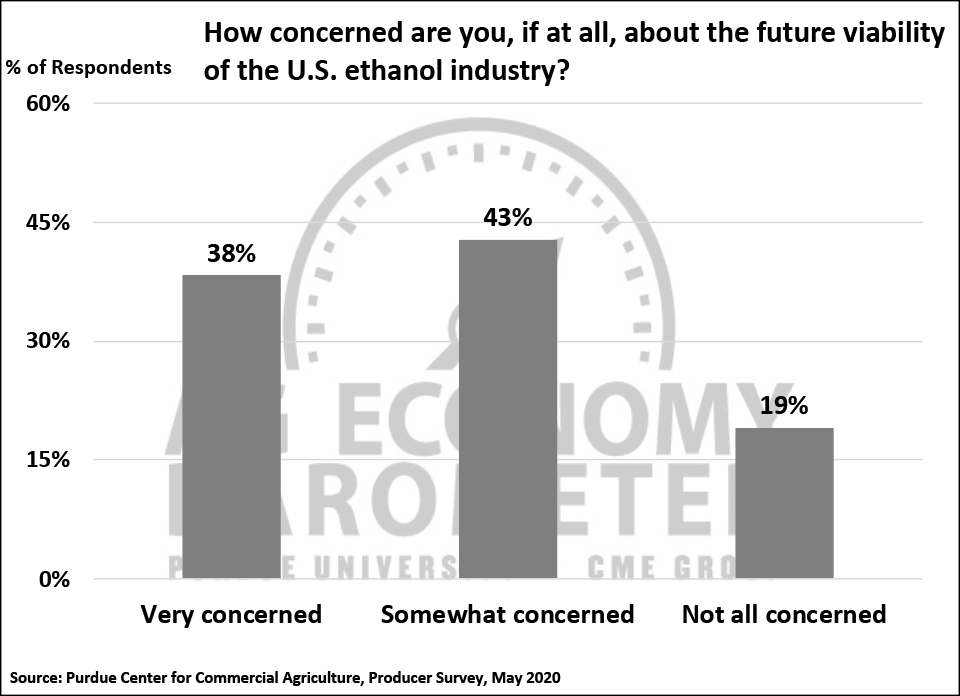

Ethanol production is an important source of demand for corn, absorbing nearly two-fifths of U.S. corn production in recent years. The worldwide decline in demand for fuel, and the resulting decline in gasoline prices, sharply reduced ethanol plant operating margins. As a result, many U.S. ethanol plants either shut down or reduced operations to minimize their losses. In the May survey, 81 percent of farmers said they were either very concerned (38 percent) or somewhat concerned (43 percent) about the future viability of the U.S. ethanol industry.

Discussions between farmers and landowners regarding cash rental arrangements for the next crop season often get underway in the summer. Given the large decline in crop margins this year, the May survey asked farmers who rent farmland if they expect to ask their landlords to reduce their 2021 cash rental rates because of COVID-19? Although two-thirds of farmers who rent farmland said no, over one out of four (27 percent) respondents said they did plan to seek a cash rent reduction in 2021.

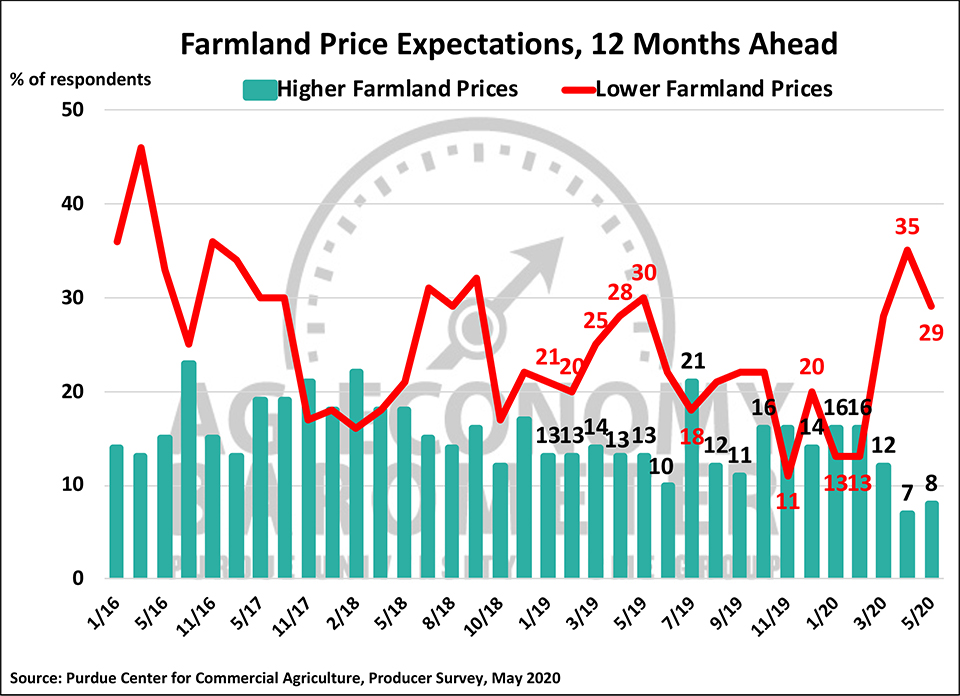

Farmers in May were somewhat less pessimistic about the short-run direction of farmland values than a month earlier, but continued to have a much more negative view than back in February. On the May survey, 29 percent of respondents said they expect farmland values to decline in the next 12 months, down from 35 percent a month earlier. This stands in sharp contrast to the 13 percent of respondents in February who expected values in the upcoming year to decline.

When asked to provide a longer-term perspective on farmland values, producers’ responses have been relatively consistent over the March-May period. Over that three-month period, the percentage of farmers expecting farmland values rise over the next five years ranged from a high of 44 percent in April to a low of 40 in May with March coming in at 41 percent. These values compare to 59 percent of respondents who expected farmland values to rise over the next five years back in February.

Wrapping Up

Farmers sentiment improved modestly in May as the Ag Economy Barometer rose to a reading of 103, but remained nearly 40 percent below its February peak of 168. Both the Index of Current Conditions and Index of Futures Expectations rose in May with the improvement in current conditions being the primary driver of the barometer’s small rise. Farmers were more inclined to view making large investments in their farming operations favorably than a month earlier, but were still much less inclined to invest in farm machinery and buildings than they were back in February. Over 70 percent of producers said they are either very worried or fairly worried about coronavirus’ impact on their farm’s profitability and over 60 percent said they expect farmers’ equity positions to decline over the next year. Just over one out of four farmers who rent farmland said they expect to ask their landlords to lower their cash rental payments in 2021 as a result of COVID-19, suggesting there will be downward pressure on cash rental rates next year. In the face of widespread ethanol plant shutdowns, over 80 percent of farmers said they are concerned about the future viability of the U.S. ethanol industry. Finally, two-thirds of producers believe it will be necessary for the U.S. Congress to pass additional legislation to provide more economic assistance to U.S. farmers.

Source: James Mintert and Michael Langemeier, Purdue University