China Reassures U.S. on Phase One Trade Purchase Goals

Bloomberg writer Peggy Collins reported late last week that, “China’s leader Xi Jinping reassured U.S. President Donald Trump in a phone call that Beijing would meet purchase goals outlined in the recent trade deal between the countries — despite the impact of the coronavirus on the Asian nation, White House economic adviser Larry Kudlow said Friday.

Bloomberg writer Peggy Collins reported late last week that, “China’s leader Xi Jinping reassured U.S. President Donald Trump in a phone call that Beijing would meet purchase goals outlined in the recent trade deal between the countries — despite the impact of the coronavirus on the Asian nation, White House economic adviser Larry Kudlow said Friday.

“‘Xi apparently said, may be a little slower to purchase American exports, but it will get done by the end of the year and next year,’ Kudlow said in a Bloomberg Television interview Friday. The virus outbreak has claimed hundreds of lives in China and impacted the economy, raising questions about whether the nation could meet targets in the trade pact.”

U.S. expects some delays in China’s purchases of American exports. Larry Kudlow, National Economic Council Director, discusses with @FerroTV https://trib.al/bGQe7HB

The Bloomberg article noted that, “‘Xi apparently reassured President Trump in this phone call that while there might be some delays in the purchase of American exports, the markers of $200 billion over the next couple of years, will in fact be met,’ Kudlow said.

Kudlow said China hasn’t formally asked for exceptions to the purchasing targets, but the two leaders and staff are talking.

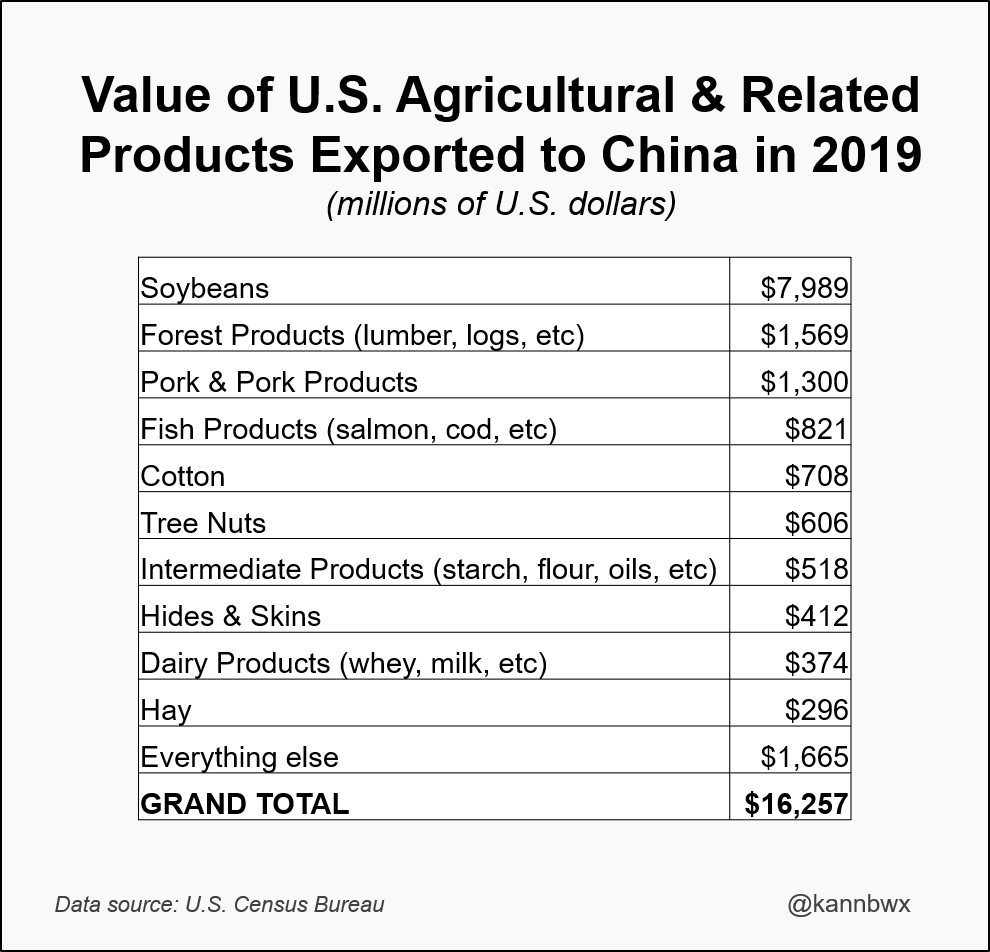

Wall Street Journal writer Kate Davidson reported on Friday that, “Under the phase-one deal signed last month, China agreed over the next two years to step up purchases of manufactured goods by $77.7 billion, tech services by $37.9 billion, energy by $52.4 billion and agriculture by $32 billion. China also agreed to steps that allow more market access for U.S. dairy products, poultry, beef, fish, rice and pet food.”

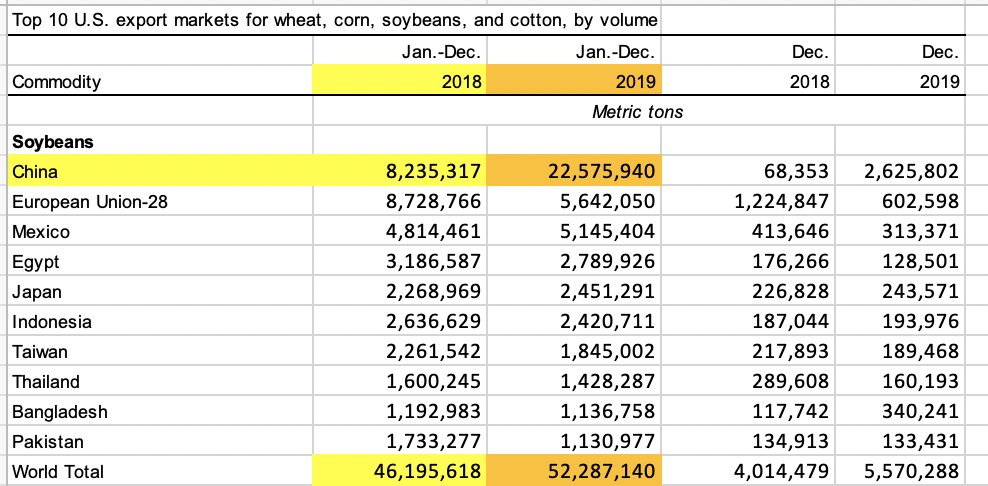

Top 10 U.S. #export markets for #soybeans, by volume https://bit.ly/2vZIbel @USDA_ERS

* #China.

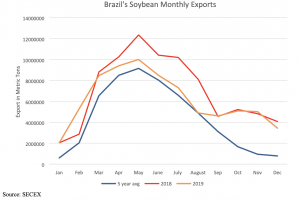

Meanwhile, a report last month from USDA’s Foreign Agricultural Service (“Brazil: Oilseeds and Products Update“) stated that, “In 2019/20, Brazil is forecast to reap a record soybean crop of 124.5 million metric tons (mmt). Post raised slightly the forecast for planted area by 100 thousand hectares to 36.9 million ha. The increase is based on marginal gains across several states. Post raised the production forecast by one mmt based on better than initially expected yields in Mato Grosso, and improved productivity expectations in Rio Grande do Sul and the Northeast.”

#Brazil’s #soy sales to #China gained momentum this week, at least 10 cargos booked , as weak #currency, low freight prices boost deals http://noticias.r7.com/economia/vendas-de-soja-do-brasil-ganham-impulso-de-cambio-e-frete-maritimo-07022020 …

Vendas de soja do Brasil ganham impulso de câmbio e frete marítimo

The report on Brazil added that, “Post forecasts soybean exports for marketing year (MY) 2019/20 (February 2020 to January 2021) to reach 75 mmt. Post’s export forecast is based on a recovery in available supplies, but also subdued demand from China for several reasons. First, China will continue to grapple with the adverse effects of the African Swine Fever (ASF) epidemic and the resulting sluggish demand for feed. Secondly, Post anticipates Brazil will lose some portion of its China export share to the United States in the wake of a Phase One trade deal between Washington and Beijing that was announced in December and signed on January 15.

“As of January, reaction to the U.S.-China trade deal has been muted, mostly because of the number of uncertainties with regard to the volume of soybeans Beijing intends to source from the United States. Although China pledged to purchase from the United States at least $36.5 billion worth of agricultural goods in 2020, and at least $43.5 billion in 2021, the publicly released text of the agreement did not disclose specific purchase commitments for any one commodity. In addition, Vice Premier Liu He noted that China would buy U.S. agricultural goods based on ‘market conditions.’”

“It remains to be seen whether China will return to the previous five-year trend pattern of sourcing soybeans in the United States in the September– January timeframe, when the U.S. harvest typically comes online. At that point, Brazilian soybeans are typically priced higher, providing the right ‘market conditions’ for purchases,” the report said.

Source: Keith Good, Farm Policy News